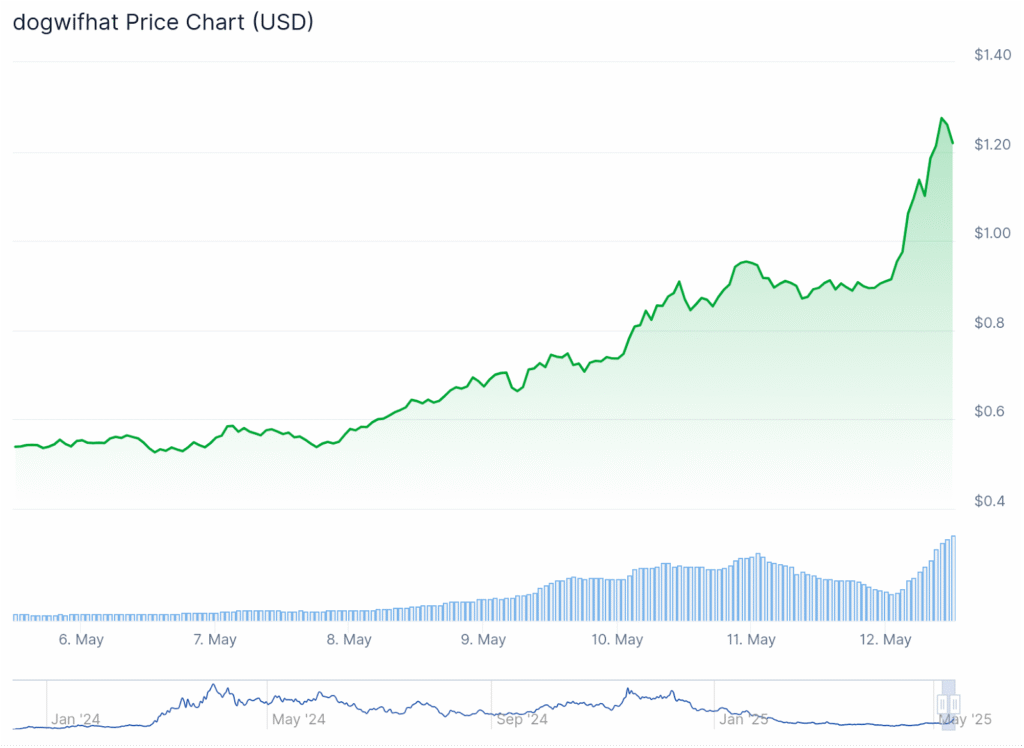

In a 24-hour surge on May 12, Dogwifhat’s $WIF skyrocketed by 45%, generating $1.27 billion in trading volume and staging a strong comeback after last month’s 300% drop.

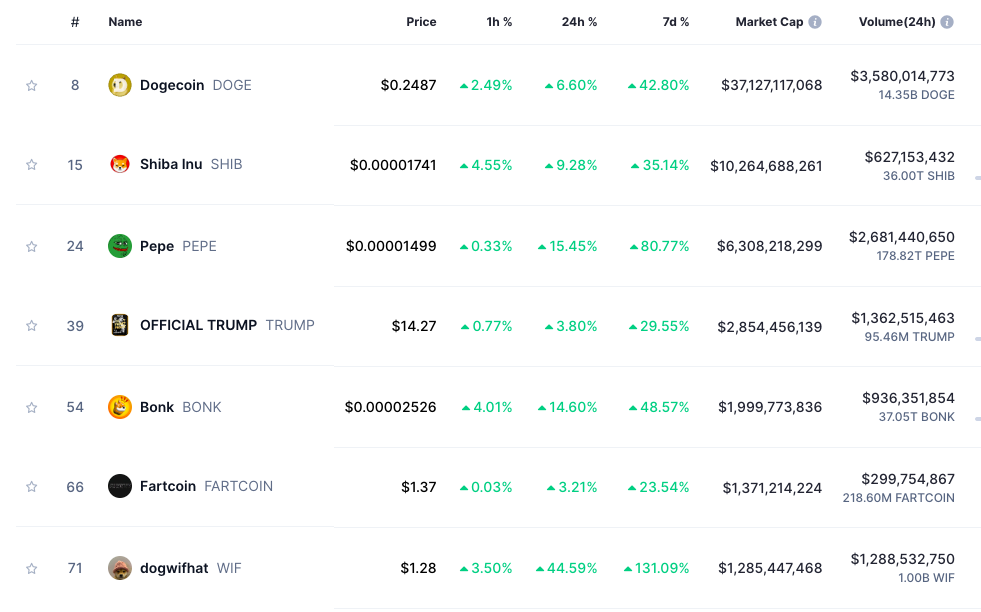

The rally has propelled the pink-hat Solana memecoin back into the top 70 cryptocurrencies by market cap for the first time since January. It also sparked a flurry of activity in the derivatives market, with open interest climbing nearly 39% as bullish traders set their sights on the $1.60 resistance level.

After reaching a high of nearly $4.80 in late 2024, the token plummeted to a low of $0.3173 last month. However, it has since mounted a strong recovery—surging more than 200% from that bottom—positioning $WIF as one of the best-performing assets in recent weeks.

Early $WIF Investors Still Up Over 550,000% Despite Volatility

Although still trading 60% below its all-time high, early investors in Dogwifhat have seen lifetime returns of over 550,000% since its launch in November 2023.

Now ranked as the seventh-largest memecoin, $WIF trails behind names like $FARTCOIN, $BONK, and $TRUMP in overall market cap—but leads the pack in weekly performance.

The recent price surge came on the heels of a May 11 tweet by prominent crypto trader Ansem, who signaled a potential uptick in WIF’s trading volume. At the time of the tweet, $WIF was hovering around the $0.80 mark.

Since Ansem’s tweet, crypto Twitter has been buzzing with traders sharing leveraged gains ranging from 100% to as much as 15,000%. Derivatives data from Coinglass indicates the momentum may not be over yet.

In the last 24 hours alone, open interest in $WIF has surged by 38.97%, with more than $500 million in positions opened. The long/short ratio currently stands at 0.994, signaling a tightly contested battle between bulls and bears.

This suggests that the majority of traders are leaning bullish, anticipating further upside in $WIF’s price action.

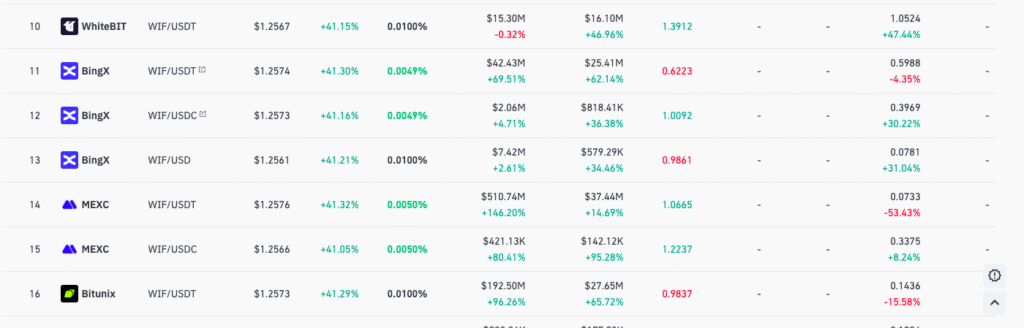

BingX Volume Spikes Hint at Asia-Led $WIF Accumulation

With $WIF already listed on major platforms such as Binance, Bybit, Coinbase, OKX, and Robinhood, bullish traders are eyeing short-term targets between $2 and $3.

However, technical analysts caution that the token faces significant resistance around the $1.50 mark, which could trigger short-term selling pressure before any further gains.

Some traders view any near-term pullback as a buying opportunity ahead of another potential rally.

Market optimism has been further fueled by the recent U.S.-China agreement to temporarily ease tariffs, sparking renewed risk-on sentiment—especially among speculative traders in Asia.

Chinese investors have been actively rotating into high-risk assets like DogWifHat and Dogecoin ($DOGE), signaling a revived appetite for memecoins.

Singapore-based exchange BingX, widely used by Chinese traders, reported a 69% surge in $WIF/$USDT trading volume over the past 24 hours, highlighting the growing momentum.

Open interest in the $WIF/$USDT pair also jumped by 62.14%, while contracts denominated in $WIF/$USDC and $WIF/$USD recorded gains of over 35%, signaling rising speculative interest across the board.

$1.60 Resistance Zone in Focus as $WIF Sets Sights on $2

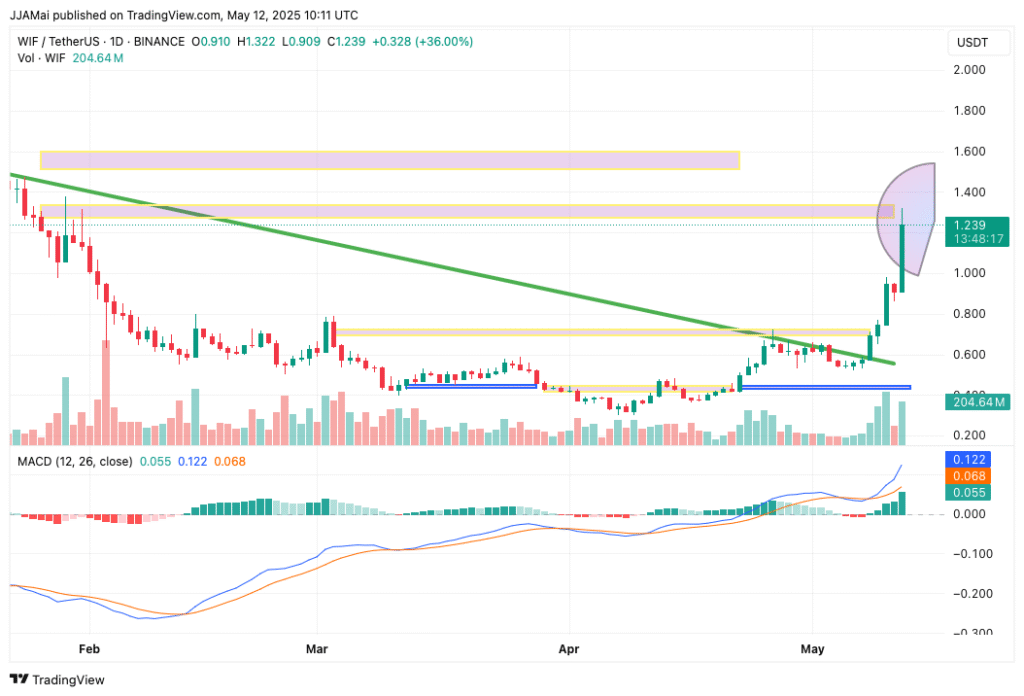

From a technical standpoint, $WIF has broken out of a prolonged consolidation phase, having established a solid base between $0.35 and $0.45, with notable resistance around $0.60. The current rally was ignited by a breakout above a descending trendline traced from the January highs, putting the $1.60 resistance zone squarely in focus as the token eyes a push toward the $2 level.

The price chart now displays a classic accumulation breakout pattern, with momentum indicators continuing to support a bullish outlook.

The MACD line is gaining distance above the signal line, accompanied by an expanding green histogram—clear signs of strengthening upward momentum and no current signs of bearish divergence.

At present, $WIF is trading within a critical resistance zone between $1.30 and $1.60, a range that previously served as a supply zone earlier this year. A shaded purple arc on the chart highlights this area as a potential zone for short-term exhaustion or consolidation before the next leg higher.

If $WIF manages to break above the $1.60 resistance, the next major target will be the psychological $2.00 level, where many traders may look to take profits.

In the case of a retracement, the previous breakout zone at $0.90 is expected to provide immediate support, while stronger support lies at $0.60, which could act as a critical level for maintaining the bullish trend.

wif Price

Leave a Reply