Stellar ($XLM) Emerges as a Top Performer with Strong Transaction Metrics

Stellar ($XLM), a blockchain-based payment network, has proven to be one of the most consistent gainers over the past month. On May 11, it surged by 7%, pushing its market valuation back above $10 billion and rounding off a 38% rally over the past 30 days—firmly positioning itself among the top 15 cryptocurrencies by market capitalization.

Stellar Surpasses Ethereum and Ripple in Key Transaction Metrics

Founded in 2014 as a fork of the Ripple protocol following internal disagreements, Stellar has long been considered a direct competitor to XRP.

Despite XRP’s significantly larger market cap—currently exceeding $150 billion—XLM has outpaced it in monthly price growth.

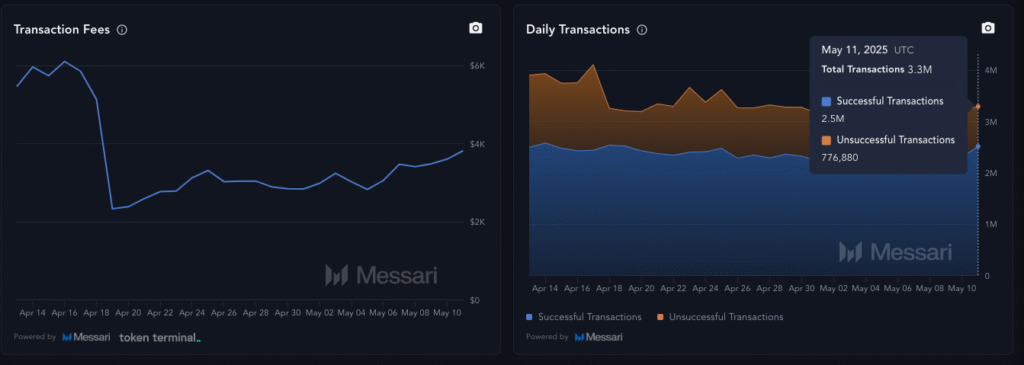

According to Messari, Stellar handled over 3.3 million transactions on May 11 alone, with total transaction fees amounting to just $4,000, highlighting its efficiency and scalability compared to many other networks.

“In contrast, Ripple handled approximately 530,000 transactions, incurring more than $3,500 in fees.

Stellar, a top smart contract platform, also demonstrates remarkable efficiency compared to Ethereum.”

“The network has processed more than 470 million transactions, maintaining an average fee of only $0.0015 per transaction. In contrast, Ethereum has recorded over 108 million transactions with an average fee of $1.90. Stellar’s adoption is also growing steadily, with over 9.5 million registered wallets, according to Stellar Explorer.

Developer engagement is gaining momentum too, with over 630,000 smart contracts deployed on the network as of May 7.”

Big Players Back Stellar: Partnerships with Mastercard, IBM, and More

“This rising adoption has caught the attention of major financial institutions, many of which are now incorporating Stellar into their systems.

One notable example is MoneyGram’s recent launch of ‘Ramps’—a developer-friendly API built on Stellar that enables smooth integration with Circle’s USDC, making it easier for users to move funds in and out of digital wallets.”

In 2024, Stellar forged significant partnerships with major players like Mastercard and Franklin Templeton. Mastercard’s Crypto Credential solution has integrated Stellar’s blockchain to enhance secure asset management.

IBM has also teamed up with Stellar to support cross-border payment systems, with a focus on the South Pacific region.

These strategic developments have strengthened investor confidence in $XLM, as reflected in its recent price momentum.

$XLM Price Prediction: Fibonacci Levels and Bullish Indicators Signal a Potential Breakout Toward $0.50

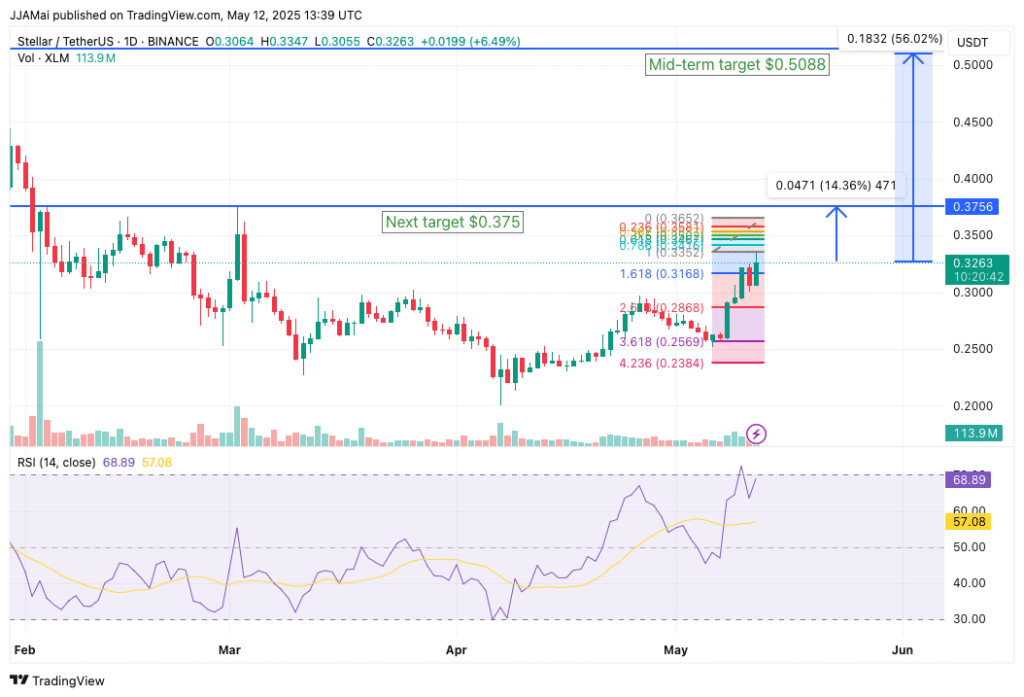

On the $XLM/$USDT daily chart, the token has recently surpassed the 1.618 Fibonacci extension level at $0.3168, which now acts as a short-term support zone.

From a technical analysis perspective, $XLM is showing signs of an emerging bullish trend, characterized by a pattern of higher highs and higher lows.

After rebounding from the $0.24 range, $XLM has been following key Fibonacci extension levels and is currently consolidating between the 1.618 and 2.0 levels.

The next significant resistance is at $0.3756—a historically important price point that could determine whether the current rally extends or encounters a short-term pullback.

Should $XLM break above this resistance, the next upside target is around $0.5088, representing a potential gain of more than 56% from its current price.

However, the Relative Strength Index (RSI) is currently at 68.89, approaching the overbought threshold. This indicates that a short-term consolidation or corrective move could be imminent.

If a pullback occurs, key support levels to monitor include $0.3168, with additional Fibonacci-based support at $0.2868 and $0.2569.

Stellar Jumps

XRP Price Prediction: South Korean Investors Bet Big on Ripple, Can XRP Reach $5 in May?

$WIF Roars Back with 200% Recovery After Brutal Crash

Solana Price Prediction: Is $200 Next for SOL After Hitting 2-month High?

Leave a Reply