Solana (SOL) Extends Rally, Hits 2-Month High

Solana (SOL) has maintained its upward momentum, recently climbing to a two-month peak of $178.33. It is currently trading around $174.59, marking a 47% gain over the past month and a 20% increase in just the last week.

This upward trend is fueled by a combination of technical breakouts, heightened DeFi activity, and improved overall market sentiment.

DeFi Strength and Cross-Chain Growth Propel Solana

A key factor behind Solana’s surge is its expanding role within the decentralized finance (DeFi) ecosystem.

Data from DefiLlama shows that Solana generated $3.32 billion in 24-hour decentralized exchange (DEX) volume, accounting for nearly 29% of the total DEX market.

These figures underscore Solana’s efficiency and scalability, solidifying its appeal among developers and traders alike.

Solana Sees $165M in Cross-Chain Inflows, Strengthens DeFi Position

In addition to its price rally, Solana has attracted over $165 million in cross-chain inflows over the past month. Notably, $80.4 million came from Ethereum, $44 million from Arbitrum, $20 million from Base, with smaller contributions from BNB Chain and Sonic.

These capital movements highlight growing investor confidence in Solana as a leading platform for DeFi and cross-chain applications.

Key DeFi Metrics:

- $3.32 billion in 24-hour DEX volume (~29% market share)

- $165 million bridged from other chains

- Major inflows from Ethereum and Arbitrum

Technical Indicators Support Bullish Outlook

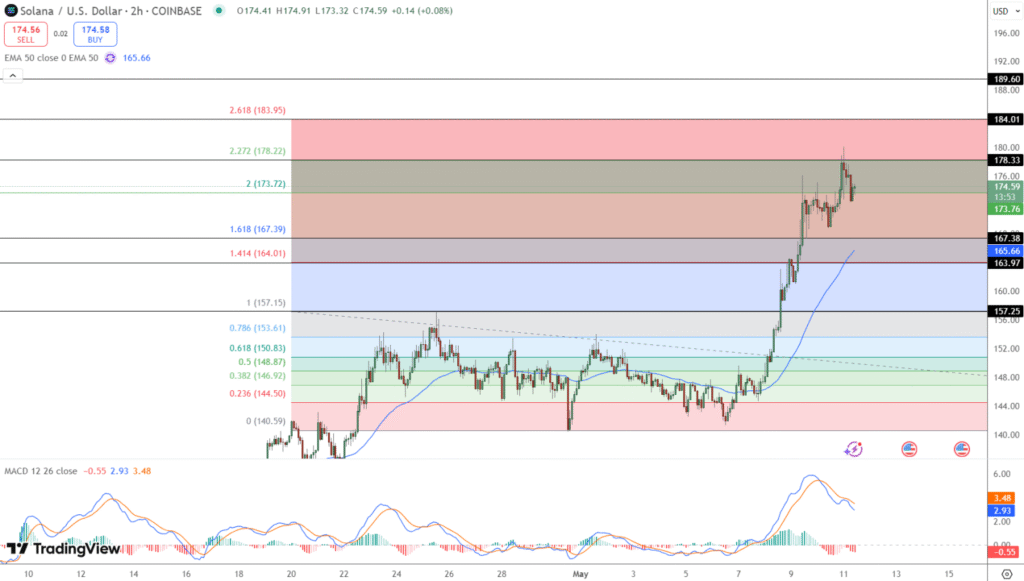

Solana’s technical setup further supports a bullish outlook. The token recently broke above its 200-day exponential moving average (EMA) and surpassed the critical 1.618 Fibonacci extension level at $167.39—both signs of a strong trend reversal.

Additionally, the formation of a “three white soldiers” candlestick pattern, a classic bullish signal, suggests sustained buying momentum and the potential for further upside.

Solana Faces Key Resistance as Momentum Shows Early Signs of Cooling

Solana currently faces immediate resistance at $178.33. If bullish momentum continues, the next upside targets are $183.95 and $189.60.

However, early signs of a potential slowdown are emerging, as the MACD begins to show signs of bearish divergence—indicating that buying pressure may be weakening.

Should a pullback occur, traders will be eyeing the $167.39 support zone, which closely aligns with the 50-day EMA at $165.66.

Technical Levels to Watch:

- Immediate Resistance: $178.33

- Next Resistance: $183.95

- Further Resistance: $189.60

- Immediate Support: $167.39

- Next Support: $164.01

- Key Lower Support: $157.15

Solana Eyes $200 as Technicals, DeFi Growth, and Macro Tailwinds Align

Solana Maintains Momentum Amid DeFi Surge

Solana (SOL) continues to extend its impressive rally, recently hitting a two-month high of $178.33 before consolidating near $174.59. The token is up 47% over the past month and 20% in just the past week, driven by a blend of technical strength, surging DeFi activity, and broader market optimism.

DeFi Inflows Signal Growing Network Dominance

One of the main catalysts behind Solana’s upward trajectory is its expanding presence in the decentralized finance (DeFi) space. According to DefiLlama, Solana recorded $3.32 billion in 24-hour decentralized exchange (DEX) volume, capturing nearly 29% of the total market share.

Additionally, cross-chain inflows have reached over $165 million in the past month, with significant capital originating from Ethereum ($80.4M), Arbitrum ($44M), and Base ($20M). These trends underscore increasing developer and investor confidence in Solana as a premier chain for DeFi and cross-chain activity.

Key DeFi Metrics:

- $3.32B in daily DEX volume (~29% market share)

- $165M bridged from other chains

- Major inflows from Ethereum, Arbitrum, and Base

Bullish Technical Signals Support Further Gains

Technically, Solana recently cleared its 200-day EMA and broke above the 1.618 Fibonacci extension level at $167.39—key indicators of a bullish reversal. Adding to the positive outlook, the appearance of a “three white soldiers” candlestick pattern suggests strong, sustained buying interest.

However, early signs of weakening momentum are emerging as the MACD shows initial bearish divergence. This raises the possibility of a short-term pullback, particularly if SOL fails to break and hold above the immediate resistance at $178.33.

Technical Levels to Watch:

- Immediate Resistance: $178.33

- Next Targets: $183.95 and $189.60

- Immediate Support: $167.39 (aligned with 50-day EMA at $165.66)

- Deeper Support Levels: $164.01 and $157.15

Macro Environment Offers Supportive Backdrop

Improved global sentiment is further fueling Solana’s rally. Positive developments in U.S.–China trade talks, spurred by recent comments from President Trump, have eased investor concerns and lifted risk appetite across markets.

This boost has helped propel the total global crypto market capitalization to $3.33 trillion, creating favorable conditions for high-beta assets like Solana.

Macro Highlights:

- Improved risk sentiment supports altcoins

- Easing U.S.–China trade tensions

- Total crypto market cap at $3.33 trillion

Outlook: Is $200 Within Reach?

With bullish technical signals, rising DeFi momentum, and favorable macro conditions, Solana appears poised for further upside. A decisive break above the $178.33 resistance could open the door to a move toward $200 in the coming weeks.

However, caution is warranted. Should the MACD divergence deepen, a pullback to support around $167.39 or lower could materialize before any continued advance.

BTC Bull Token Raises $5.58M as 78% APY Staking Draws Interest

Elsewhere in the market, BTC Bull Token ($BTCBULL) has surpassed $5.58 million in funding as it nears its $6.27 million presale cap. Priced at $0.002505, the token is gaining attention for blending meme coin culture with practical utility through flexible staking.

Utility-Focused Tokenomics Driving Demand

Unlike many meme coins, $BTCBULL offers a 78% APY on fully liquid staking—allowing users to unstake at any time without penalties or lockups. This model appeals to investors seeking yield without compromising access, particularly in today’s volatile market.

Solana Price

Bitcoin Price Prediction: New U.S. Crypto Laws Could Push BTC Toward $200K

Leave a Reply