Sei’s total value locked (TVL) has exceeded $500 million, leading analysts to project potential price targets—including a possible retest of $1.14 and further upside momentum.

Sei (SEI) Dips 5% Amid Broader Rally — Is the Token Undervalued?

Sei ($SEI), a general-purpose Layer-1 blockchain that combines key advantages of Ethereum and Solana, saw its price decline by 5% over the past 24 hours. Despite the short-term dip, the token has shown impressive momentum, posting a 30% gain over the past week and extending its monthly growth to 42%.

At the time of writing, $SEI is trading at $0.2559. For perspective, the token reached a peak above $0.70 in December 2024 before entering a prolonged correction, bottoming out at $0.1445 in April 2025.

Since launching in August 2023, Sei has positioned itself as a high-performance blockchain optimized for speed and scalability. These technological advantages—particularly its chain-level optimizations—have attracted a growing number of decentralized exchanges and trading protocols to the platform.

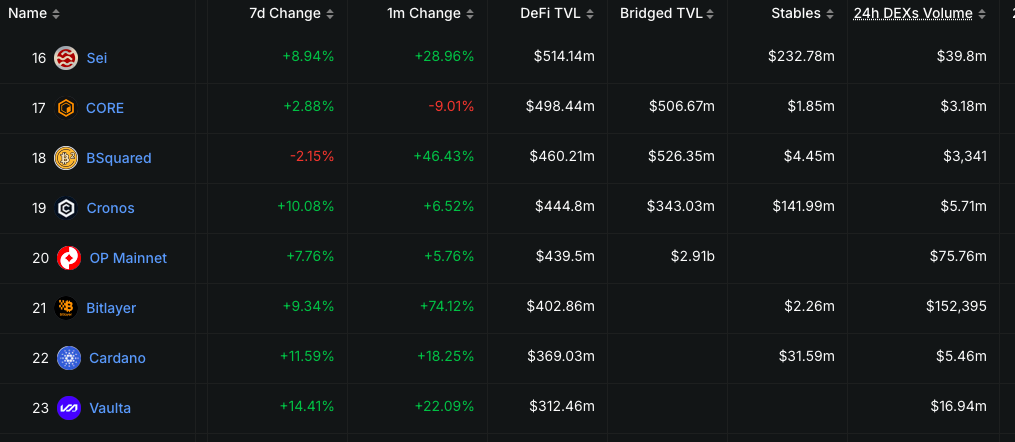

Is SEI Undervalued? Metrics Outshine Cronos, Optimism, and Even Cardano

A May 8 report from Messari highlighted Sei’s rapid growth in Q1 2025, with total value locked (TVL) jumping 73.7% quarter-over-quarter—from $209.1 million to $363.1 million. The network’s stablecoin market cap also reached a record high of $178 million.

With its TVL now surpassing $500 million, analysts are starting to view $SEI as undervalued compared to competitors like Cronos, Optimism, and Cardano. Price targets are emerging, with some calling for a potential revisit to the $1.14 level and further upside if momentum continues.

These metrics have continued to climb in Q2, with Sei’s total value locked (TVL) now exceeding $500 million and the network’s stablecoin market cap reaching $232.5 million.

Despite these strong fundamentals, the gap between Sei’s price and its on-chain activity has prompted many analysts to argue that $SEI is still significantly undervalued.

Although Sei currently ranks as the 67th-largest crypto asset by market cap—valued at approximately $1.3 billion—it surpasses several higher-ranked networks, including Cardano, Cronos, and Optimism, in both network activity and total assets locked.

For instance, Cronos is currently ranked 42nd with a market cap of $2.6 billion, Optimism ranks 65th at $1.32 billion, and Cardano remains in the top 10 with a valuation exceeding $28 billion—all despite lagging behind Sei in key DeFi activity metrics such as total value locked and stablecoin market cap.

Is a Breakout Imminent? Capital Inflows and Institutional Moves Signal Bullish Outlook for $SEI

Many analysts believe that as investor capital and attention shift toward Sei, the token could reclaim its March 2024 high of $1.14—or potentially surpass it.

Trump-Linked WLFI and Sei ETF Filing Boost Investor Sentiment

Institutional interest in $SEI is gaining traction. In April, World Liberty Financial (WLFI)—a Trump-affiliated crypto initiative—acquired 4.89 million $SEI tokens, valued at approximately $775,000. This purchase adds to a growing portfolio that also includes Bitcoin and Ethereum.

Further fueling bullish sentiment, Canary Capital filed a proposal with the U.S. Securities and Exchange Commission (SEC) on April 30 for the first spot Sei ETF. Notably, the ETF would feature a staking component, with BitGo and Coinbase named as custodians in the S-1 filing.

Together, these developments signal growing confidence in Sei’s long-term viability and suggest the token is well-positioned to benefit from renewed retail and institutional liquidity.

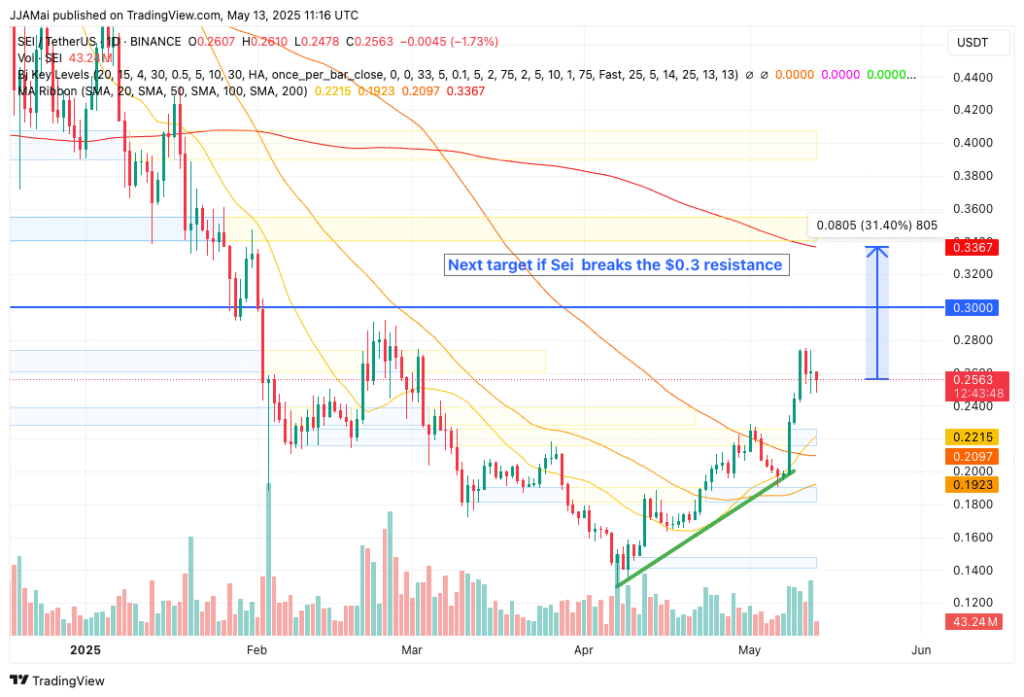

Key Resistance at $0.30: Can $SEI Break Out Toward $0.3367?

From a technical perspective, $SEI continues to exhibit a bullish structure, supported by an ascending trendline that began forming in April.

The price has climbed above the 20-day, 50-day, and 100-day exponential moving averages (EMAs), which are currently clustered between $0.1923 and $0.2214—indicating strong underlying momentum.

The next immediate resistance lies at $0.30. A confirmed breakout above this level could pave the way toward the next target at $0.3367, potentially reigniting a broader rally.

Critical Resistance at $0.30: Can $SEI Confirm the Next Bullish Leg?

A key resistance level for $SEI sits at $0.30. A decisive breakout above this threshold could trigger a 31.4% rally toward the next target of $0.3367—aligned with the 200-day EMA and a key resistance zone from late 2024.

To sustain its current momentum, $SEI must hold support above the $0.24–$0.25 range. A drop below this area could open the door for a deeper pullback, with notable support levels at $0.22, $0.2097, and $0.2000.

Conversely, a confirmed move above $0.30 would likely validate the continuation of $SEI’s bullish breakout pattern, setting the stage for further upside in the coming weeks.

Sei

Solana Price Prediction: Is $200 Next for SOL After Hitting 2-month High?

Leave a Reply