$PEPE Cools After Meteoric Rise — Profit-Taking Begins as Market Cap Hits $5.9B

After an explosive 84% surge in just three days, $PEPE soared to a $5.9 billion market cap, briefly capturing the spotlight as one of crypto’s hottest memecoins. However, by May 13, the token edged down 2.9%, signaling that profit-taking may be starting to outweigh the momentum from long-term holders and meme-fueled optimism.

Despite the slight pullback, $PEPE remains one of the best-performing ERC-20 tokens, boasting a 92.65% gain over the past month and 49.52% year-to-date. These remarkable returns have pushed the frog-themed token firmly into the top 25 cryptocurrencies by market cap, solidifying its status as a major player in the memecoin arena.

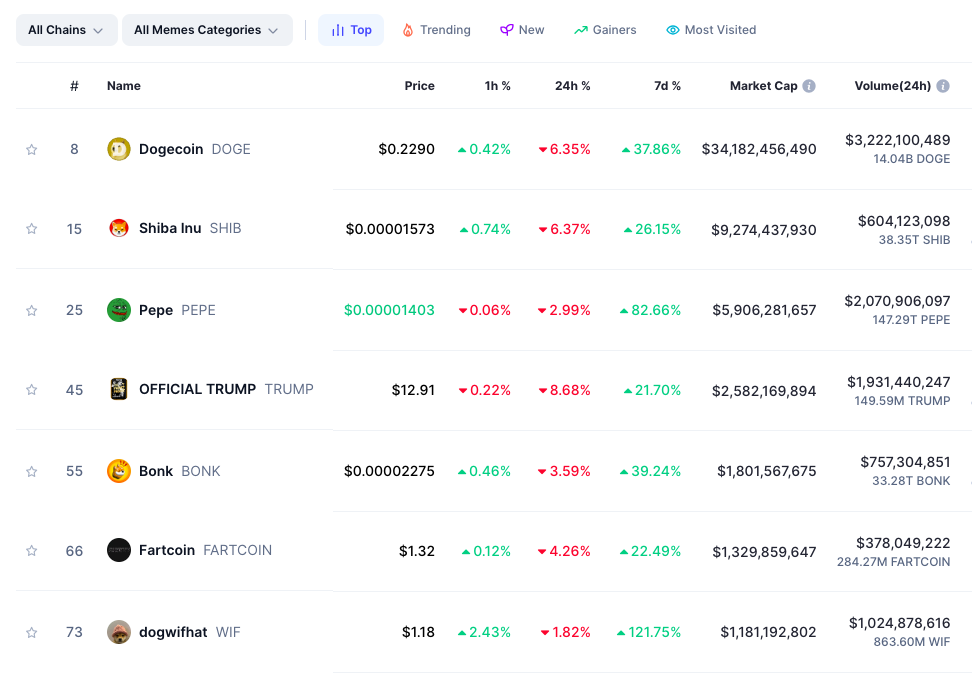

Memecoin Season Heats Up: $PEPE Trails Only $SHIB and $DOGE

Within the memecoin sector, $PEPE firmly holds its position as the third-largest by market capitalization, ranking just behind Dogecoin ($DOGE) and Shiba Inu ($SHIB).

$PEPE currently ranks as the third-best-performing memecoin this week, trailing only $WIF and $PNUT.

This sustained interest highlights a recurring trend: when trading volume returns to the crypto markets, memecoins often lead the charge. Their volatility and short-term trading potential make them an attractive alternative to more traditional altcoins for many investors.

For perspective, the total memecoin market capitalization was approximately $55 billion at the start of May. Just 12 days later, it had surged over 45%, reaching $72.2 billion.

This broader rally is clearly mirrored in $PEPE’s performance. On March 11, its market cap hovered around $2.4 billion. Within a month, it soared more than 120%, driven in part by Ethereum’s strong recovery—from a low of $1,380 to over $2,500. As an ERC-20 token, $PEPE often rides the wave of Ethereum’s bullish momentum.

Other Ethereum-based tokens, like $NEIRO—which surged 50% in the past 24 hours—are also benefiting from the broader influx of liquidity across the ecosystem.

Is $PEPE Cooling Off or Gearing Up for Another Rally?

Sentiment around $PEPE is currently divided. While some traders are bracing for a cooldown, others remain firmly bullish. One notable example is a trader on Hyperliquid who opened a $2.3 million long position on $PEPE using 3x leverage—signaling strong conviction in further upside.

Meanwhile, prominent crypto analyst @CryptoKaleo suggested that $PEPE may enter a consolidation phase before making another leg up, potentially targeting a conservative market cap range of $10 billion to $20 billion in the next rally.

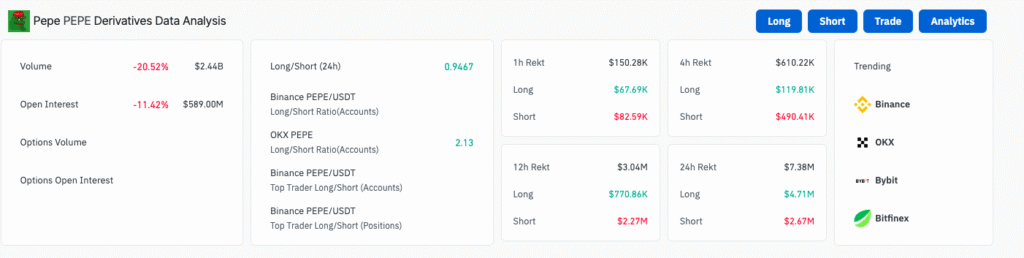

However, derivatives data hints at more than just short-term profit-taking. Over the past 24 hours, $PEPE’s trading volume has dropped by more than 20%, while open interest has declined by 11.42%. These figures suggest a cooling of speculative appetite, as leveraged traders scale back their positions—often a sign that momentum is pausing rather than reversing.

While this reset could precede a healthier consolidation phase, it also raises questions about the strength of immediate bullish continuation, especially if volume fails to recover.

As a result, more than $4.71 million in long positions have been liquidated. On the other hand, on-chain metrics tell a different story. $PEPE’s holder count has climbed to over 432,000, underscoring persistent retail interest and network growth. This rise in unique wallets indicates that many investors are holding rather than exiting—suggesting that conviction remains strong despite short-term volatility.

Additionally, wallet activity hints at accumulation, with some investors appearing to buy the dip, anticipating another leg higher as broader market sentiment improves.

Technical Analysis: Can $PEPE Break Through $0.0000159 Resistance?

From a technical standpoint, $PEPE is trading just below a key resistance level at $0.0000159. A confirmed daily close above this zone would mark a bullish breakout, potentially triggering a 31% rally toward the next resistance band between $0.00001946 and $0.00002000.

Momentum indicators remain mixed, but a surge in volume or positive macro news could act as the catalyst needed for this next leg higher. Traders will be closely watching for a breakout candle with strong volume confirmation, as this could validate a trend continuation rather than a false breakout.

The recent breakout from a symmetrical triangle pattern around the $0.00000800 level has propelled $PEPE to new local highs. This technical move highlights significant bullish momentum, reinforcing the market’s positive outlook on the token.

However, one cautionary indicator is the Relative Strength Index (RSI), which is elevated at 84.16, signaling that $PEPE is overbought in the short term. Typically, such overbought conditions precede brief periods of consolidation or pullbacks. These corrections, though potentially short-lived, can be considered healthy for the overall upward trend, allowing for a reset of the momentum.

A pullback to the breakout zone between $0.00001050 and $0.00001200 could provide a favorable re-entry opportunity for bullish traders, provided that buying pressure remains intact. Should this zone hold as support and volume pick up, it would validate the bullish continuation and offer a more stable foundation for the next rally.

$PEPE Slips 3

SEI Dips 5% But DeFi Growth Soars: Is This Layer-1 Gem Being Overlooked?

Leave a Reply