Hyperliquid’s $HYPE Soars Over 1,000% in 5 Months — Is This Crypto’s Next BNB?

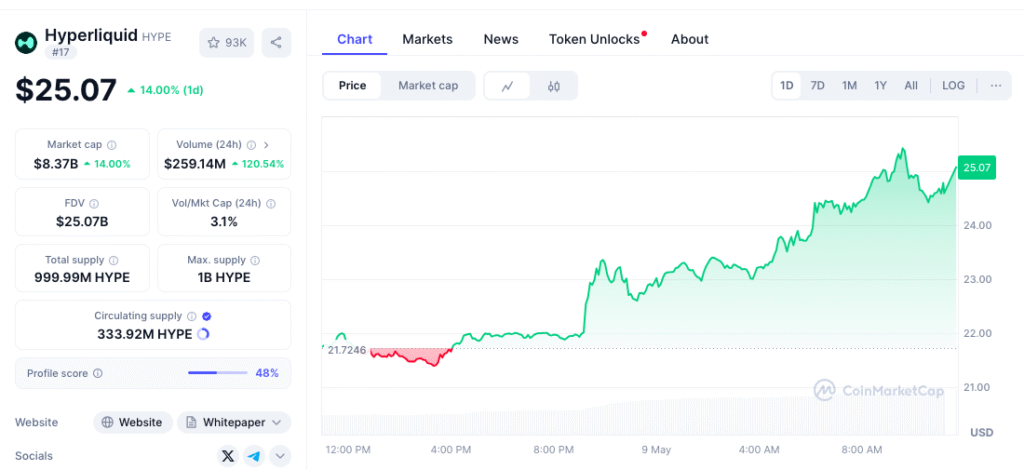

$HYPE has skyrocketed more than 1,000% in just five months, and on May 8, open interest shattered the $4.9 billion mark. The token is now rallying another 16% today, prompting traders to speculate whether it could be the next BNB-level success story.

Driven by aggressive 97% revenue buybacks and surging USDe stablecoin inflows, the DeFi-focused Layer-1 has seen explosive growth. $HYPE’s market cap has now surpassed $8 billion, overtaking both Polygon and Cardano in daily DEX volume.

The on-chain perpetual exchange, renowned for its order book architecture, has seen $HYPE soar from a post-launch low of $3.20 to a recent high of $35.02.

Despite a broader market cooldown, $HYPE has held its momentum firmly, breaking into the top 20 crypto assets by market capitalization—a testament to its strong fundamentals and rising investor interest.

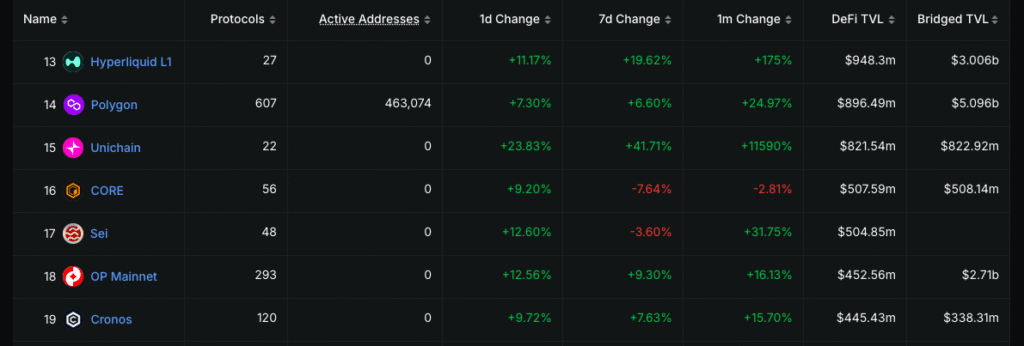

Ethena’s USDe Launch Adds Momentum to Hyperliquid Ecosystem as it Overtakes Cardano, Polygon in Key Metrics

Hyperliquid is positioned as a next-generation blockchain built to support all forms of finance. Its decentralized exchange (DEX) stands out with ultra-low fees, lightning-fast transactions, and advanced trading tools—a combination that continues to attract an expanding base of active traders.

In a major boost to the ecosystem, Ethena Labs recently launched its USDe stablecoin on both the Hyperliquid exchange and HyperEVM, enabling users to earn daily auto-airdropped rewards directly on their spot USDe balances.

According to DeFiLlama, Hyperliquid now commands over $948 million in total value locked (TVL) and $279 million in DEX trading volume, outperforming rival chains like Polygon, Sei, Cronos, and Cardano across several key on-chain metrics.

Can $HYPE Mirror BNB’s Meteoric Rise?

Hyperliquid generated an impressive $2.3 million in revenue over the past 24 hours, making it the second-highest-earning application—trailing only Solana and outpacing Ethereum by nearly $1 million.

This level of revenue underscores the presence of real, sustained user activity on the chain. The $HYPE token is a direct beneficiary, as 97% of daily revenue—approximately $1.3 million on average—is funneled into price support and supply reduction mechanisms, creating a powerful feedback loop for token value.

At the current pace, projections indicate that a significant portion of $HYPE’s total supply could be repurchased within 2 to 7 years, depending on broader market conditions.

This aggressive and sustainable model has drawn comparisons to Binance’s $BNB, which soared from $40 in 2021 to over $620, reinforcing investor belief that $HYPE could follow a similarly explosive trajectory.

Technical Breakout Points to More Upside for $HYPE

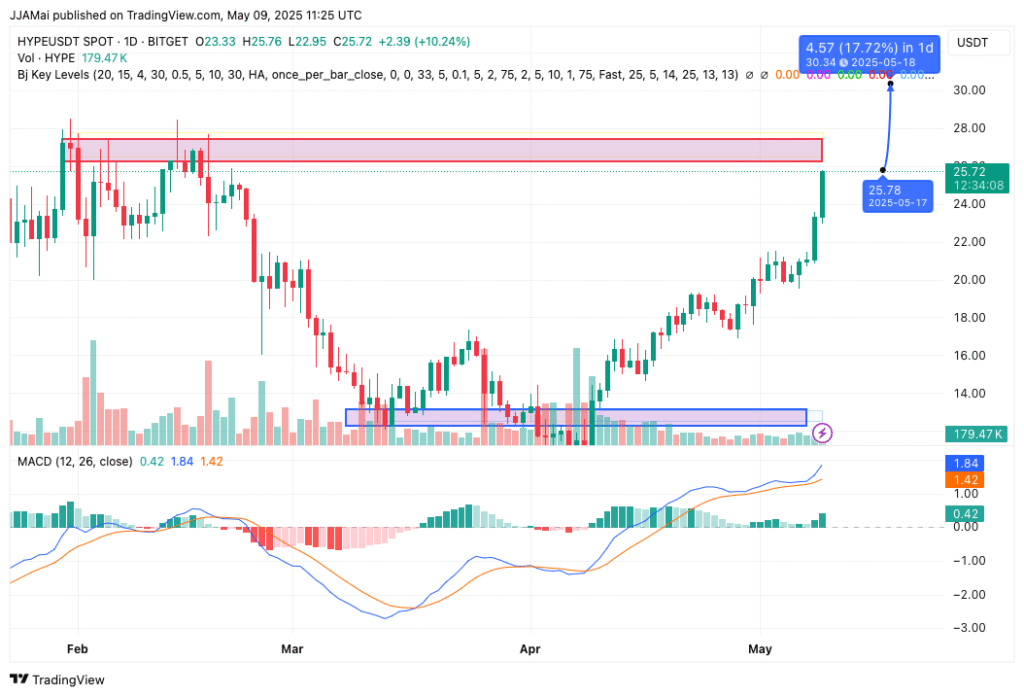

From a technical standpoint, $HYPE spent much of March and early April consolidating in the $12–$14 range, establishing a solid support foundation. Since then, the token has entered a steady uptrend, characterized by a clear pattern of higher highs and higher lows—a classic sign of sustained bullish momentum.

$HYPE recently broke above a key resistance zone at $25, backed by strong trading volume and a decisive bullish candlestick, signaling sustained upward momentum.

Technical indicators further support the bullish outlook—MACD shows the MACD line trending well above the signal line, while the histogram remains firmly in positive territory, confirming continued buying pressure.

Current projections suggest a near-term target of $30.34, representing a potential 17.72% upside from current levels. This aligns with a significant resistance zone last tested in February.

In the event of a retracement, the $25 level is likely to act as new support, while a deeper pullback could find strong buying interest between $14.50 and $16.00—the foundational demand zone that launched the current rally.

Leave a Reply