Ethereum (ETH) capped off a strong late-week rally with a 40% surge, but early signs of buyer exhaustion are emerging—prompting concerns about a potential short-term correction.

Ethereum’s Breakout Faces Resistance at $2,500 — But Fundamentals Are Strengthening

Last week, Ethereum (ETH) delivered its strongest performance since December 2020, surging 40% and breaking out of a month-long consolidation range between $1,450 and $1,900. However, with momentum slowing near the $2,500 level, bullish price forecasts are being reassessed as signs of buyer fatigue begin to emerge.

Still, several catalysts are helping to shift sentiment. The launch of the highly anticipated Pectra hard fork, combined with easing macro headwinds—most notably progress on a U.S.-China trade agreement—has cleared much of the stagnation that previously weighed on the leading altcoin.

Now trading above its consolidation ceiling, ETH is regaining its footing in the “best crypto to buy” conversation.

Why This Rally Stands Out

What sets Ethereum’s current rally apart from many altcoin surges is its foundation in spot market demand rather than excessive leverage or short-term speculation.

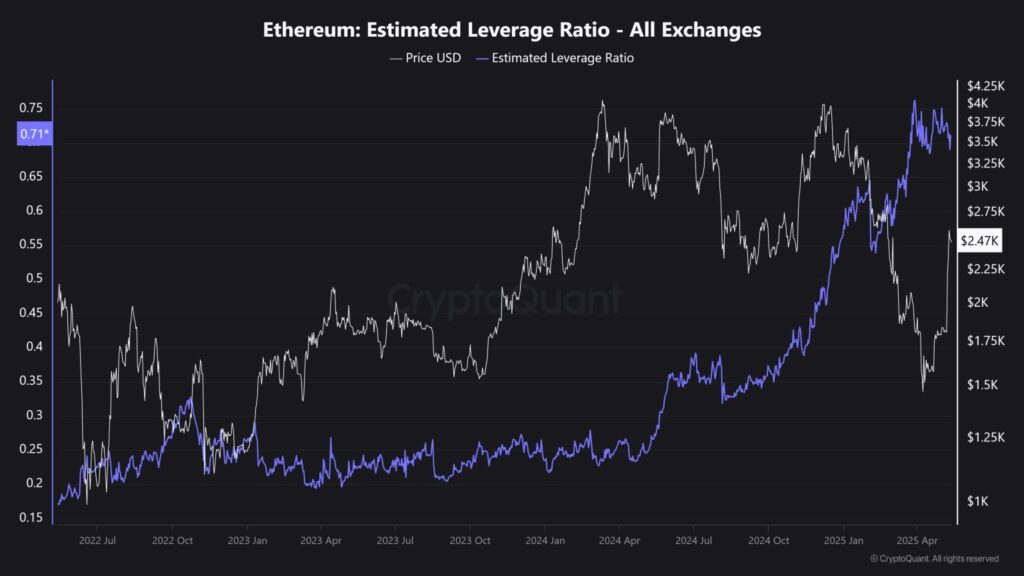

According to data from CryptoQuant, Ethereum’s estimated leverage ratio (ELR) dropped from 0.76 to 0.69 last week. This decline indicates that traders are dialing back leveraged positions, suggesting the rally is being fueled by genuine buying interest rather than frothy derivatives activity.

In addition, Ethereum has seen significant trade outflows, with approximately 323,700 ETH withdrawn from exchanges over the past four days. Meanwhile, staking activity has surged, with over 180,000 ETH added to staking contracts in the past week alone.

These trends suggest that investors are increasingly shifting toward long-term holding strategies, rather than engaging in short-term speculative trading.

Ethereum Price Analysis: Can the Uptrend Continue?

The recent slowdown aligns with emerging bearish technical signals. The daily Relative Strength Index (RSI) has entered overbought territory at 80—an indication of mounting buyer exhaustion.

As the saying goes, “what goes up must come down,” and a short-term correction appears likely to restore balance in the market.

However, there’s a bullish undertone. A long-term symmetrical triangle pattern, in development since 2021, is back in play after a brief false breakdown. This renewed structure is supported by strong momentum indicators, hinting that any correction could be a healthy pause before a larger breakout.

Ethereum Outlook: Technical Breakout and Macro Tailwinds Support Bullish Case

Ethereum’s RSI has now broken decisively into bullish territory, rising above its signal line after previously lingering in the 40s—an early sign that bearish momentum has faded and buyers are regaining control.

Adding to this shift, the MACD has flipped bullish for the first time since the post-inauguration rally. It has formed a golden cross—where the MACD line crosses above the signal line—suggesting a potential long-term trend reversal, especially on this higher time frame.

The 200-day simple moving average (SMA) has also reestablished itself as strong support. This reinforces the idea that ETH may have already bottomed and is now building the foundation for a sustained uptrend.

If buying pressure resumes, Ethereum could attempt a breakout from its long-standing symmetrical triangle pattern. The next immediate target lies at $2,970, representing a potential 17% gain. A more aggressive move toward retesting the triangle’s upper boundary would require a 50% rally, bringing ETH close to the $3,750 level.

On the fundamental side, the upcoming Pectra hard fork and easing global macroeconomic conditions further strengthen Ethereum’s long-term bullish case—supporting both investor confidence and continued network growth.

Ethereum Price

$WIF Roars Back with 200% Recovery After Brutal Crash

Solana Price Prediction: Is $200 Next for SOL After Hitting 2-month High?

Leave a Reply