Cardano’s momentum has slowed as broader crypto markets react to recent U.S. economic data, prompting a wave of caution among investors. However, analysts suggest that a sudden surge in trading volume could reignite bullish sentiment and potentially push ADA to new highs.

Despite the current pause, ADA remains on traders’ watchlists, with some speculating that renewed interest and favorable market conditions could set the stage for a breakout.

Amid uncertain macroeconomic conditions, Cardano price forecasts are gaining momentum as the altcoin experiences renewed investor interest. On Thursday morning, an impressive 996,010,000 ADA tokens were traded, signaling a possible shift in sentiment.

A 6% gain by the daily close points to a potential reversal, following a sluggish week in which ADA posted losses in five of the last six sessions.

Broader market momentum has slowed, largely due to growing concerns over the U.S.-China trade war’s impact on consumers and the first U.S. GDP contraction since Q1 2022. As a result, many traders have opted to reduce their exposure.

However, with this latest surge in volume and price action, Cardano is reentering the spotlight and could make a strong case as one of the “best cryptos to buy” amid the current market shakeout.

Upcoming Catalysts Bolster the ADA Price Outlook

With the Federal Reserve meeting scheduled for May 6–7, anticipation is mounting that signs of economic contraction could lead to interest rate cuts later this year.

Although traders currently see a low probability of a rate cut next week—93.2% expect the Fed to hold rates steady, according to CME Group data—expectations for policy easing are increasing for the June meeting.

Such a policy shift could trigger short-term economic growth and renewed enthusiasm across financial markets, potentially boosting bullish Cardano price forecasts.

Adding to the optimism, Polymarket bettors are showing their highest confidence yet, with odds reaching an all-time high of 71% in favor of a Cardano ETF being approved in 2025.

This untapped institutional demand could drive Cardano’s price higher, paving the way for broader exposure through traditional investment channels such as ETFs and regulated funds.

Cardano Price Analysis: Is $100 ADA Close?

While a $1000 price for Cardano is an unrealistic near-term target given ongoing economic concerns that are dampening risk-on sentiment, there is still a valid argument that ADA could experience a surge.

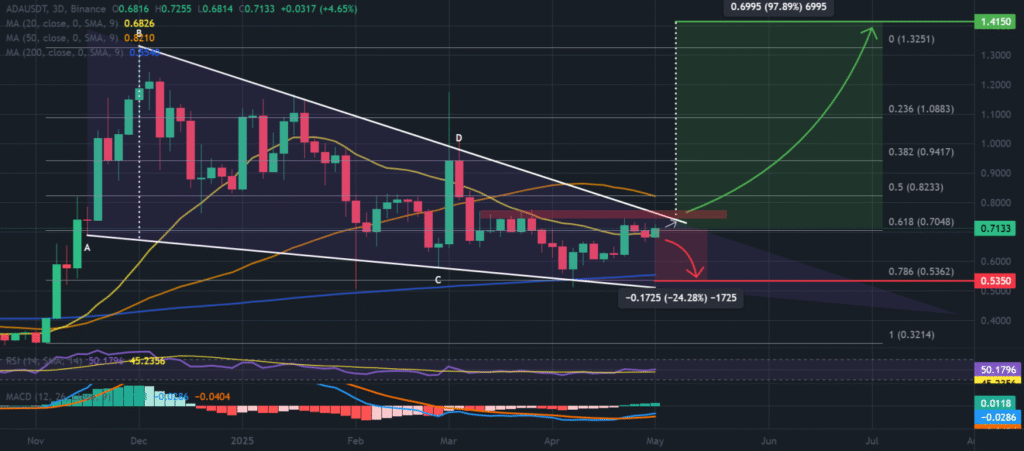

In the short term, Cardano’s price faces a significant hurdle at the $0.70 resistance level, which must be broken in order to trigger a breakout from a 5-month symmetrical triangle pattern.

ADA / USDT 3-day chart, symmetrical triangle pattern. Source: TradingView / Binance.

A clear move above the $0.70 resistance level would bring the $0.75 resistance into focus, which could serve as a key retest point aligning with the upper boundary of the current price channel.

If Cardano can decisively break through this range, the rally that began in April could signal a broader trend reversal, potentially pushing the price up by another 100% toward $1.40.

This scenario is credible as momentum indicators continue to lean bullish. The MACD is widening its lead above the signal line, suggesting that a long-term uptrend may be forming.

However, the RSI remains below the neutral 50 mark after a recent rejection, indicating that while bullish momentum is building, sellers haven’t been fully overpowered yet.

A rejection from current levels could result in a 25% retracement back to lower support at $0.53.

Nevertheless, if momentum persists and the breakout is confirmed, the path toward a $100 ADA—though still far off—could begin to materialize sooner than many expect.

This New ICO Could Push a Rival Chain Ahead

Those who have looked to Cardano as a Layer-1 alternative to Solana might want to reconsider, as Solaxy ($SOLX) has just addressed one of Solana’s biggest weaknesses: scalability.

For many users, failed transactions have been a major frustration with Solana. However, this narrative could change with the introduction of Solaxy, Solana’s first-ever Layer-2 scaling solution, which aims to resolve these issues and improve the platform’s overall performance.

By processing transactions off-chain and finalizing them on Solana, Solaxy greatly reduces congestion and lowers transaction costs, while ensuring seamless interoperability between both blockchains.

With over $32.7 million raised in its ongoing presale, investors are already showing strong support for the project. As demand for Solana grows, Solaxy could be in a prime position to benefit from the influx of new liquidity into the ecosystem.

GENIUS Act Revival Triggers Senate Showdown Over $2B Trump Stablecoin Deal

Leave a Reply