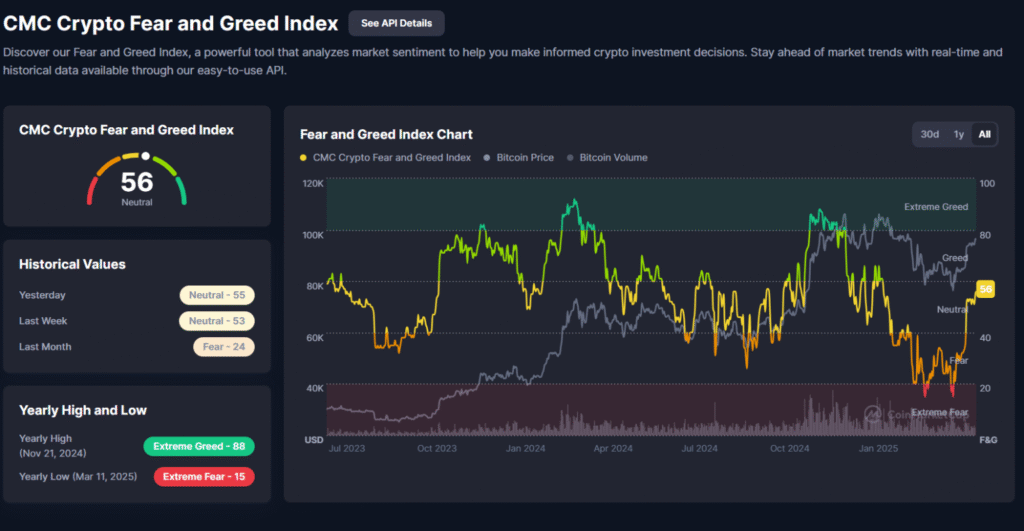

Bitcoin (BTC) holds steady near $96,362 as market sentiment shifts from fear to greed. The latest update from the CMC Fear and Greed Index shows a jump to 56, a significant rise from 24 just a month ago, signaling increased investor confidence and risk appetite.

Despite a modest 0.44% dip in the past 24 hours, Bitcoin’s overall upward trend remains solid. With a market capitalization of $1.91 trillion and 19.85 million coins in circulation, BTC’s resilience is being supported by stable technical indicators and improving market sentiment.

- Fear and Greed Index: 56 (Neutral to Greed)

- Monthly Low: 24 (Fear)

- Yearly High: 88 (Extreme Greed)

- Market Cap: $1.91T

- 24-Hour Trading Volume: $23.8B

This uptick in sentiment coincides with tangible developments and growing institutional interest, potentially reinforcing Bitcoin’s bullish outlook into the second quarter.

Adoption and Regulation Reshape the Narrative

Two key developments are boosting confidence in crypto’s legitimacy as an asset class.

First, in a major step toward modernizing retail commerce, an estimated 90% of stores in Cannes, France, are set to accept cryptocurrency payments by summer 2025.

Lunu Pay reports that merchant training workshops are already in progress, as businesses gear up to integrate Web3 payment systems. Cannes now joins the ranks of forward-looking cities like Lugano and Panama City, where crypto adoption is rapidly entering the mainstream.

Second, a regulatory clampdown is gaining momentum.

U.S. authorities have launched an investigation into Cambodia-based Huione Group, which is allegedly tied to $98 billion in illicit crypto transactions since 2014. The Financial Crimes Enforcement Network (FinCEN) has designated Huione a “primary money laundering concern,” a move hailed by compliance professionals as a pivotal step forward in tightening crypto enforcement.

Meanwhile, the SEC—facing mounting pressure after recent legal setbacks—may shift toward a more cooperative approach to crypto regulation, potentially taking cues from the IRS’s advisory-first model.

Together, these developments point to a broader evolution—marking crypto’s transition from its “Wild West” origins to a more regulated, institution-ready ecosystem.

Bitcoin Technical Levels to Watch

Bitcoin is currently consolidating above a key ascending trendline that has been in place since late April.

The 50-period EMA at $95,833, along with the 0.382 Fibonacci retracement level at $96,048, is offering solid near-term support.

If BTC holds this support zone, a rebound could push prices toward $96,782 and $97,329, with a potential retest of the recent high at $97,966.

Trade Setup

- Entry: $96,000–$95,800 (upon bounce confirmation)

- Targets: $97,330 → $97,960

- Stop Loss: Below $95,450

While the setup appears constructive, traders should exercise caution. The MACD is showing signs of weakening momentum, and a clean breakout—or confirmation via a bullish MACD crossover—would strengthen the case for new long positions.

Conclusion

With improving sentiment, expanding real-world adoption, and increasing regulatory clarity, Bitcoin’s current consolidation may be laying the groundwork for its next upward move.

Though short-term volatility persists, the $96K level continues to attract strong buying interest—suggesting that the path of least resistance could still be to the upside.

BTC Bull Token Crosses $5.28M as Flexible 78% Staking Yield Draws Investors

BTC Bull Token ($BTCBULL) is gaining momentum, surpassing $5.28 million in presale funding as it approaches its $5.96 million cap.

Priced at $0.00249, $BTCBULL is positioning itself as more than a meme coin—offering real-world value through flexible, high-yield staking options.

Utility-Driven Tokenomics Power Investor Interest

Setting itself apart from typical meme tokens, BTCBULL combines viral crypto culture with practical staking utility. Investors can currently earn an estimated 78% APY, with the added benefit of full liquidity—unstaking is allowed at any time with no penalties or lockup periods.

This approach has struck a chord with yield-seeking investors who want passive returns without giving up access to their funds—especially in today’s unpredictable market.

Current Presale Stats:

- USDT Raised: $5,284,443 of $5,963,550

- Current Price: $0.00249 per BTCBULL

- Staking Pool Total: 1,342,549,903 BTCBULL

- Estimated Yield: 78% annually

With less than $680K remaining until the next milestone, the presale window is closing rapidly. For investors seeking high yields with the flexibility to exit at any time, BTCBULL is rapidly emerging as a top contender for the 2025 crypto cycle.

New Litecoin Price Prediction Targets $100 and Beyond – Where Is LTC Headed Next?

Dogecoin Price Coiling for a Monster Move – Are Whales Betting on $5 DOGE?

$MOVE Sinks 70% – Founder Suspended, Coinbase Pauses Trading. What’s Next?

$IMX Soars 24% in 4-Hour Rally – Can Immutable Lead the Next Web3 Gaming Boom?

Bitcoin Price Prediction: The Stock Market Just Sent a Major Buy Signal — Time to Buy?

XRP Future Price Prediction: ETF Rumors Reignite 10x Bull Case – Here’s What Traders Expect

Leave a Reply