Bitcoin Holds Steady Above Key Support as Institutional Momentum Builds

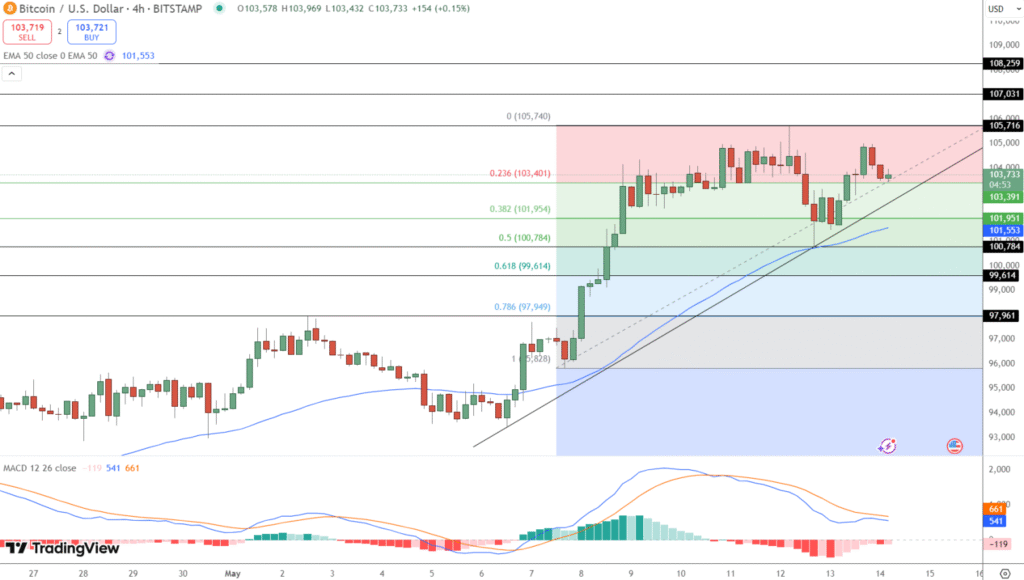

Bitcoin (BTC/USD) is currently trading around $103,733, maintaining stability just above the 23.6% Fibonacci retracement level at $103,400. While broader market conditions remain relatively calm, a wave of institutional activity signals growing momentum beneath the surface.

One of the most notable developments is the recent inclusion of Coinbase (COIN) in the S&P 500—a historic milestone for the crypto industry. Analysts at Bernstein forecast that this move could attract up to $16 billion in inflows, with $7 billion expected from active funds and $9 billion from passive index trackers. This reinforces the growing integration of crypto into traditional financial markets and strengthens Bitcoin’s long-term investment case.

ChatGPT a dit :

“Crypto is here to stay,” affirmed Coinbase CEO Brian Armstrong, emphasizing Bitcoin’s growing role in mainstream finance and underscoring its potential for deeper integration into the global financial system.

Meanwhile, Israeli brokerage eToro is targeting a $620 million raise through its upcoming Nasdaq IPO, with shares priced at $52 each. Supported by major underwriters including Citi and Goldman Sachs, the move reflects increasing investor appetite for regulated crypto-focused platforms, further cementing the industry’s legitimacy.

ETF Scare Highlights Bitcoin’s Volatility, But Recovery Shows Resilience

Last month’s brief Bitcoin surge—triggered by a false tweet about ETF approval from a compromised SEC account—served as a reminder of the market’s acute sensitivity to regulatory developments. The incident, traced back to a SIM swap hack by Eric Council Jr., underscores the vulnerabilities in digital communication. Council is set to be sentenced later this week. Despite the scare, Bitcoin quickly rebounded, demonstrating underlying investor confidence.

Although the hacker’s actions had no lasting effect on Bitcoin’s price, the episode highlights the fragility of key information channels—and how quickly misinformation can move markets worth billions.

Despite ongoing regulatory uncertainty, overall sentiment remains positive, bolstered by cooler U.S. inflation data. The Consumer Price Index (CPI) came in at 2.3% year-over-year, below analyst expectations. This has increased the likelihood of two Federal Reserve rate cuts in 2025, putting downward pressure on the U.S. dollar and reinforcing Bitcoin’s bullish setup heading into the summer months.

Bitcoin Technical Outlook: Key Levels to Watch

Bitcoin’s price outlook remains bullish as it continues to trade along an ascending trendline, staying well above the 50-period EMA at $101,553. This suggests sustained short-term bullish momentum. While the MACD histogram is beginning to flatten—indicating possible consolidation—there are no clear signs of bearish divergence, keeping the overall technical structure intact.

Key Levels for Bitcoin (BTC/USD):

- Buy Zone: $102,500–$103,000 (ideal for dip entries)

- Target 1: $105,700

- Target 2: $107,000

- Stop Loss: Below $101,500

A decisive breakout above $105,716 could ignite a push toward $108,000, with growing institutional momentum reviving conversations around a potential $120,000 macro target. Wall Street’s accelerating exposure to crypto assets continues to be a key driver of this bullish narrative.

BTC Bull Token Crosses $5.70M as 73% Staking Yield Captivates Crypto Investors

BTC Bull Token ($BTCBULL) is gaining rapid traction in the presale arena, surpassing $5.70 million raised as it nears its updated funding cap of $6.69 million.

Currently priced at $0.00251, BTCBULL is positioning itself as more than a meme coin—delivering real utility through high-yield, flexible staking that aligns with the demands of modern crypto investors.

Flexible Staking Model: 73% APY, No Lockups

What distinguishes BTCBULL from other staking projects is its fully liquid staking system, offering up to 73% annual yield with no lockup periods or early exit penalties. This user-centric approach provides:

- Immediate access to staked assets

- Ongoing yield accumulation

- No commitment constraints

In an environment where most DeFi protocols impose long-term restrictions, BTCBULL’s liquidity-friendly model is attracting both risk-aware and yield-driven participants. As 2025’s altcoin cycle gains momentum, BTCBULL’s flexibility and utility are making it a standout choice for investors seeking growth without rigidity.

Bitcoin Price

Stellar Jumps 38%, Crushes XRP on Transactions as Bulls Eye $0.50 Breakout

Leave a Reply