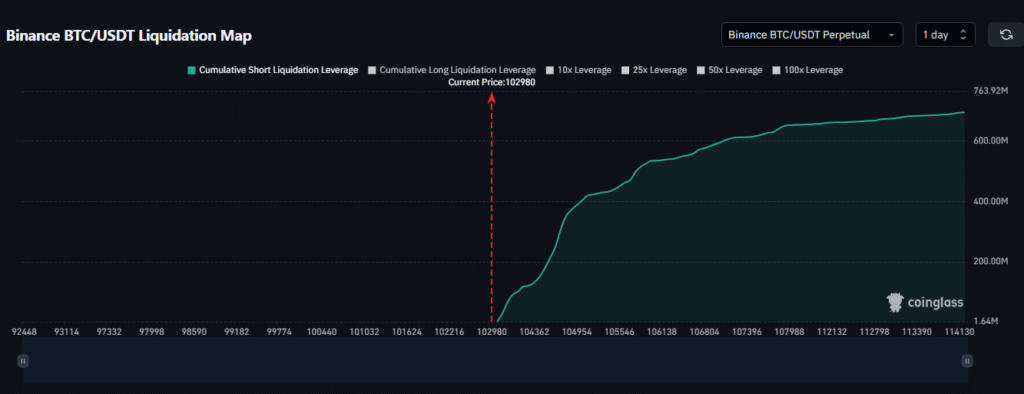

Bitcoin Dips to $102,980 as $730M in Shorts Liquidated—Volatility Remains High

Bitcoin (BTC) faced another sharp bout of volatility early Tuesday, briefly plunging to $102,980 before finding support and stabilizing. The sudden drop triggered a surge in forced liquidations, with Coinglass data revealing that over $730 million in short positions were wiped out—one of the largest single-day liquidation totals in recent weeks.

This extreme price action underscores the ongoing vulnerability of overleveraged traders on both sides of the market. In a macro-sensitive crypto environment, where sentiment can shift rapidly, excessive leverage remains a high-risk strategy.

BTC Liquidations Top $730M as Longs Take the Hit — CPI Miss Adds Macro Uncertainty

Notably, 73% of the liquidations were long positions, highlighting the vulnerability of bullish traders during rapid market reversals. The largest single liquidation recorded was a BTC/USD contract worth over $11 million on Bybit, underscoring the scale of leveraged exposure at risk.

CPI Miss Supports Fed Caution, Bitcoin Reacts Calmly

Contributing to the market’s whipsaw behavior was the release of U.S. Consumer Price Index (CPI) data for April. Headline inflation rose just 0.2% month-over-month, below the expected 0.3%, while the year-over-year figure held steady at 2.3%.

The softer-than-expected CPI print supports a more cautious approach from the Federal Reserve on future rate hikes. While the data initially added to macro uncertainty, Bitcoin ultimately reacted with relative composure, stabilizing after its earlier dip—suggesting that broader investor sentiment may remain intact despite short-term volatility.

Inflation Cools, but Bitcoin Stalls as Market Weighs Mixed Signals

April’s softer-than-expected CPI data helped ease inflation concerns, reinforcing expectations that the Federal Reserve may delay any further interest rate hikes. However, Bitcoin (BTC) didn’t immediately rally on the news, reflecting a broader market hesitation.

Despite the encouraging macro signal, investors appear to be balancing inflation relief against persistent geopolitical tensions and positioning risks tied to excessive leverage in the futures market.

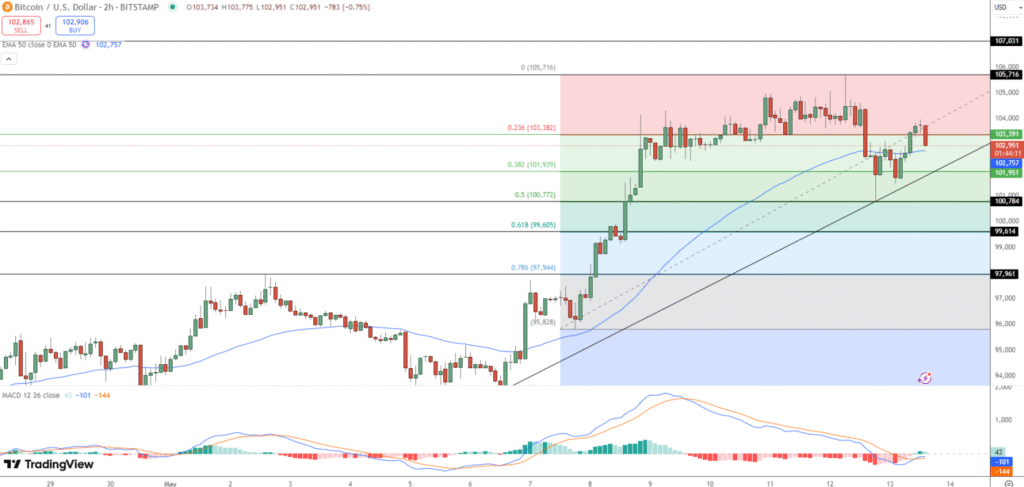

Bitcoin Holds Key Support Above $102,750 as Bulls Eye $105K Retest

Currently trading at $102,951, Bitcoin is holding firm above a critical support zone after briefly testing resistance at $103,382, which aligns with the 23.6% Fibonacci retracement level from the recent high of $105,716.

Price action is also supported by the 50-period EMA at $102,757, which overlaps closely with the 38.2% Fib level at $101,951 and an ascending trendline—creating a strong technical confluence.

This structure suggests the broader bullish trend remains intact, and a sustained hold above this zone could set the stage for a retest of the $105,000 resistance in the near term.

Bitcoin Technical Outlook: Bullish Continuation in Play

BTC Price Prediction:

The MACD histogram is showing early signs of a bullish reversal, with momentum weakening on the downside. A sustained move above $103,382 would validate a bullish continuation toward the next target at $105,716.

On the flip side, a break below $101,950 could expose downside risks, potentially testing $100,772 and $99,600 as key support zones.

Trade Setup:

- Buy Zone: $102,750–$103,000 (Above trendline and 50 EMA)

- Target 1: $105,000

- Target 2: $107,000

- Stop Loss: Below $101,900

New Traders: Wait for a bullish candle close above $103,382 or a MACD crossover to confirm upward momentum. As long as BTC holds trendline support, the momentum favors the bulls.

BTC Bull Token: High-Yield Staking Draws Investors

In the altcoin space, BTC Bull Token ($BTCBULL) has raised $5.67 million in its presale and is nearing its $6.69 million target. At a price of $0.00251 per token, BTCBULL has quickly gained attention for offering utility beyond speculative trading, with a flexible, high-yield staking model.

Flexible Staking Model:

BTCBULL provides an attractive 73% APY without the typical lockup periods or exit penalties, making it appealing to yield-hungry investors looking for liquidity in a volatile market. This flexibility allows investors to react quickly to market changes without being tied to long-term commitments.

BTC Bull Token Presale Update: Momentum Building as Deadline Approaches

Current Presale Stats:

- Funds Raised: $5,674,905.59 of $6,690,863

- Current Price: $0.00251 per BTCBULL

- Total Staking Pool: 1,432,976,427 BTCBULL

- Estimated Yield: 73% annually

Why BTCBULL Stands Out:

Unlike typical meme tokens, BTCBULL offers tangible utility through its flexible staking platform, making it an appealing choice for yield-focused investors. With a 73% annual yield, BTCBULL caters to those seeking high returns while maintaining liquidity in an evolving market.

As the 2025 crypto cycle gains momentum, BTCBULL has positioned itself as a standout option, particularly for those looking for stable returns in the midst of volatility.

Closing Window: With less than $1.01 million left before the next price increase, the presale window is closing quickly. This urgency is fueling investor interest, making it an opportune moment for those looking to get in before the price hike.

Bitcoin Price

$WIF Roars Back with 200% Recovery After Brutal Crash

Solana Price Prediction: Is $200 Next for SOL After Hitting 2-month High?

Leave a Reply