Bitcoin Surges Past $100K as Institutional Investment Momentum Builds

Bitcoin (BTC) has broken through the key $100,000 threshold, currently trading around $103,688. This breakout marks a 7.6% gain over the past week, fueled by renewed institutional interest and favorable macroeconomic conditions.

A notable catalyst was Goldman Sachs’ recent disclosure of a $1.65 billion investment in Bitcoin through exchange-traded funds (ETFs), highlighting the increasing confidence among major financial institutions in the long-term viability of digital assets.

This strategic move aligns Goldman Sachs with other financial giants like BlackRock and Fidelity, further cementing Bitcoin’s status as a mainstream investment asset.

Beyond Wall Street, institutional momentum continues globally. Japanese firm Metaplanet Inc. recently issued $21.25 million in bonds specifically to increase its Bitcoin reserves. At current prices, this capital injection enables the acquisition of approximately 206 BTC, solidifying Metaplanet’s role as one of the largest public holders of Bitcoin.

These developments underscore a broader trend of corporations increasingly turning to Bitcoin as a strategic asset to diversify their balance sheets. As more companies and financial institutions integrate BTC into their long-term investment strategies, Bitcoin’s role as a digital store of value continues to gain legitimacy and momentum.

U.S.-U.K. Trade Deal Hints Boost Market Sentiment

Adding to the bullish momentum, emerging signals of a potential U.S.-U.K. trade deal are helping fuel Bitcoin’s upward trajectory.

U.S. President Donald Trump recently hinted at the possibility of a new trade agreement with the U.K., easing market anxieties surrounding tariffs and boosting investor confidence.

As the transatlantic trade relationship shows signs of strengthening, overall market sentiment has improved, prompting a shift toward risk-on assets like Bitcoin as investors seek to capitalize on the renewed optimism.

This positive news comes on the heels of the U.S. Federal Reserve’s decision to keep interest rates steady at 4.25%–4.50%, a move that has contributed to a broader improvement in risk appetite across financial markets.

Together with easing trade tensions, these favorable macroeconomic signals have reignited investor interest in higher-beta assets such as Bitcoin, further fueling its recent surge.

Bitcoin Price Levels to Watch

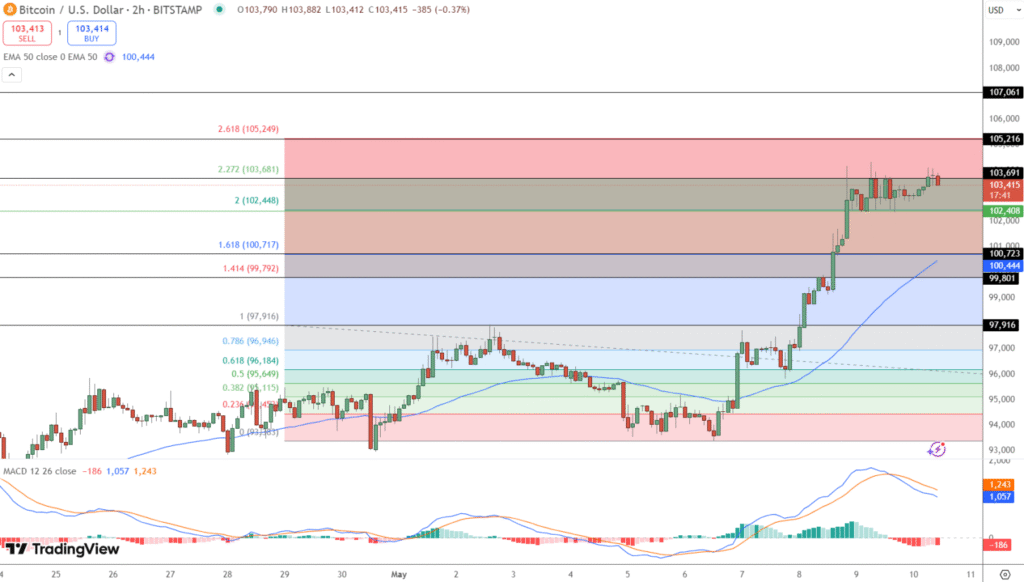

From a technical perspective, Bitcoin is consolidating just below a key Fibonacci resistance level at $103,681. A breakout above this threshold could open the door to the next target at the 2.618 Fibonacci extension of $105,249, implying a potential upside of approximately 1.5%.

However, caution is warranted as the MACD is beginning to show signs of a bearish crossover, suggesting the possibility of a short-term pullback before any further upward movement.

Bitcoin (BTC) – Technical Trade Setup

- Immediate Resistance: $103,681 (2.272 Fibonacci extension)

- Next Resistance: $105,249 (2.618 Fibonacci extension)

- Immediate Support: $102,448 (2.0 Fibonacci level)

- Next Support: $100,717 (1.618 Fibonacci level)

Trade Setup:

- Buy Above: $103,681

- Take Profit: $105,249

- Stop Loss: $102,448

Strategy:

Consider initiating a long position if BTC breaks and holds above $103,681, with an upside target at the 2.618 Fibonacci extension of $105,249. To manage risk, set a stop-loss just below the $102,448 support level. A drop below this support could signal a potential deeper correction.

BTC Bull Token Crosses $5.54M as Flexible 78% Staking Yield Draws Investors

BTC Bull Token ($BTCBULL) Gains Momentum as Presale Nears Cap

BTC Bull Token ($BTCBULL) continues to attract investor interest, surpassing $5.54 million in funds raised as it approaches its $6.27 million presale cap.

With a presale price of $0.002505, BTCBULL is positioning itself beyond the realm of meme coins by offering practical utility through flexible, high-yield staking.

Utility-Driven Tokenomics Powering Demand

Unlike conventional meme tokens, BTCBULL fuses crypto culture with real financial incentives. It currently offers an estimated 78% APY through a staking model that prioritizes liquidity—allowing users to unstake at any time without penalties or lockups.

This approach has struck a chord with investors looking for yield opportunities that don’t compromise access, especially amid ongoing crypto market volatility.

Current Presale Snapshot: BTC Bull Token ($BTCBULL)

- USDT Raised: $5,544,498 of $6,272,266

- Current Price: $0.002505 per BTCBULL

- Staking Pool Total: 1,342,549,903 BTCBULL

- Estimated Annual Yield: 78%

With under $727,000 remaining before the presale cap is reached, time is running out for early investors. Offering high-yield staking with full liquidity, BTCBULL is quickly emerging as a standout in the 2025 crypto landscape—appealing to those seeking strong returns without restrictive lockups.

Bitcoin Price

Solana Price Prediction: Superstate’s SEC-Approved Platform Could Drive a 10x Run

Hyperliquid Hits $4.9B Open Interest as $HYPE Soars 1,000% – BNB 2.0?

Leave a Reply