Aave ($AAVE), the native token of the prominent DeFi lending platform, is currently priced at $165.88, reflecting a 5.7% decline over the past 24 hours.

After reaching an all-time high of $666.86 during the 2021 DeFi bull market, $AAVE has since fluctuated within a range of $100 to $350. Despite recent market turbulence, the token has surged 86.43% year-to-date, recovering significantly from its July 2024 low of $91.70.

Initially launched in 2017 as “ETHLend,” Aave was created by founder and CEO Stani Kulechov as a peer-to-peer lending protocol built on Ethereum.

The platform enables users to lend and borrow a wide range of cryptocurrencies through smart contracts, establishing itself early on as a foundational component of the decentralized finance (DeFi) ecosystem.

Inside Aave’s Explosive On-Chain Growth And The $1M Weekly Plan Fueling $AAVE’s Rally

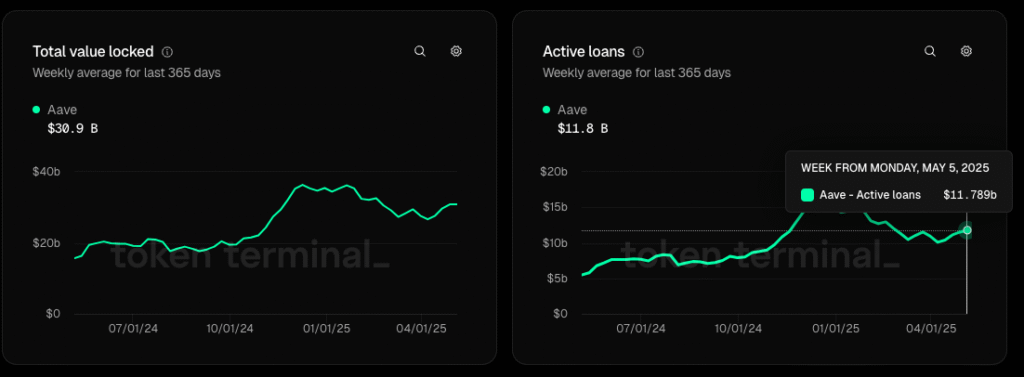

Based on data from Token Terminal, Aave currently secures more than $30.8 billion in total value locked (TVL).

According to Token Terminal, Aave currently boasts over $30.8 billion in total value locked (TVL), reaffirming its position as one of the largest DeFi protocols by assets secured. Active loans on the platform have also surged, reaching $11.8 billion—a 15.7% increase in just the past 24 hours.

Aave continues to rank among the top revenue-generating protocols in decentralized finance, having generated $569.3 million in total fees over the past year. Of this, $93 million has been recorded as protocol revenue.

Investor sentiment toward $AAVE has strengthened recently, boosted by the protocol’s announcement of a buyback initiative. In March, Aave committed to repurchasing $1 million worth of $AAVE tokens weekly for a minimum of six months.

According to Token Terminal, Aave currently secures over $30.8 billion in total value locked (TVL), reinforcing its status as one of the largest DeFi protocols by assets under management. Active loans on the platform have also climbed to $11.8 billion, marking a 15.7% increase in the past 24 hours.

The protocol remains a top performer in terms of revenue, having generated approximately $569.3 million in fees over the past year, with $93 million recognized as protocol revenue. On a monthly basis, Aave brings in around $50 million in fees—part of which is now being redistributed to token holders. This revenue-sharing model has played a role in boosting investor confidence and contributed to a 14.85% increase in $AAVE’s price over the past 30 days.

Investor sentiment was further bolstered by the announcement of a buyback program in March, under which Aave committed to repurchasing $1 million worth of $AAVE tokens weekly for at least six months.

Aave’s Trump-Backed DeFi Alliance And Expansion to Celo, Aptos, and MetaMask

Aave has recently drawn attention from prominent players in the crypto space. In October 2024, World Liberty Financial (WLFI)—a crypto initiative backed by Donald Trump—proposed building a DeFi platform on top of Aave. The proposal included a 20% revenue-sharing arrangement with AaveDAO and a 7% allocation of WLFI’s native governance token. By December, WLFI had invested $1 million into Aave, acquiring over 3,357 $AAVE tokens.

The protocol has also continued to expand its technical footprint. On March 16, Aave V3 was deployed on Celo, a Layer-2 blockchain designed for fast, low-cost transactions. The deployment supports $CELO, $USDT, and $USDC as both collateral and borrowable assets. In April, Aave began preparing for a deployment on Aptos, a high-performance Layer-1 blockchain, with the mainnet launch anticipated in the near future.

In a move to improve usability and real-world utility, Aave recently partnered with MetaMask. This integration enables users to utilize Aave USDC (aUSDC) with the MetaMask Card, allowing them to earn yield while spending, seamlessly combining DeFi benefits with everyday financial activity.

Further expanding its ecosystem, Aave integrated Ripple’s enterprise-grade stablecoin, RLUSD, into its V3 Ethereum Core market in April. This addition allows users to supply and borrow RLUSD directly through the platform, enhancing asset diversity and reinforcing Aave’s role as a flexible, multi-asset lending protocol.

Technical Outlook: $AAVE Targets $190 With Inverse Head and Shoulders Setup

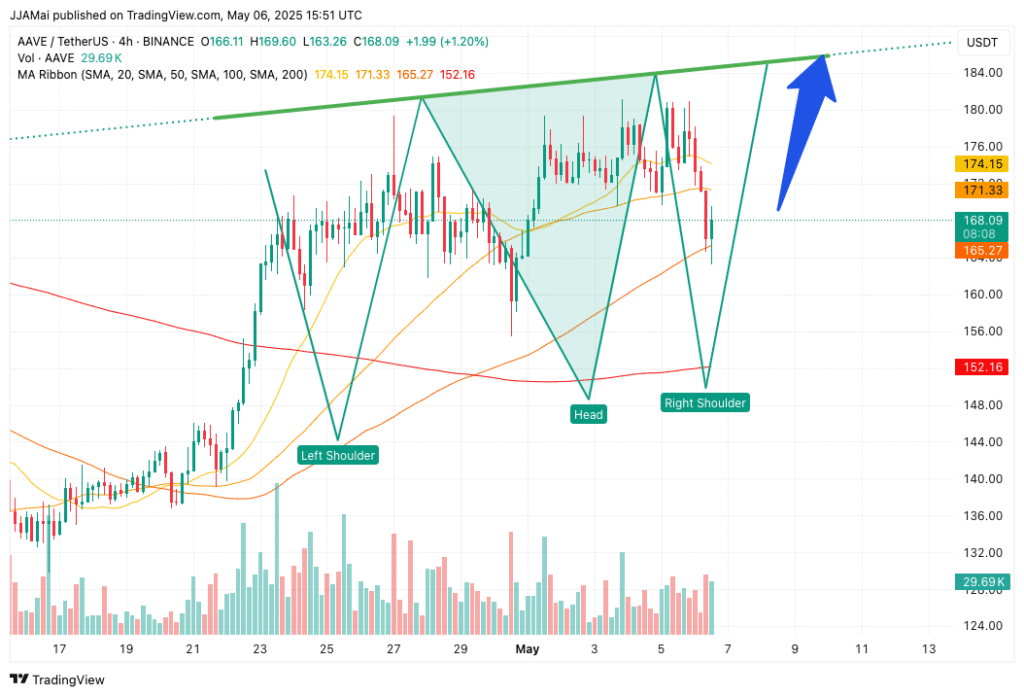

On the technical front, the $AAVE/$USDT chart reveals a clearly defined Inverse Head and Shoulders pattern—an established bullish indicator often signaling a potential trend reversal following a prolonged downtrend.

On the technical front, the $AAVE/$USDT chart displays a well-formed Inverse Head and Shoulders pattern—a classic bullish setup suggesting a potential trend reversal after a downtrend. The left shoulder formed around $160, followed by a deeper head dipping to the $148–$150 range. The right shoulder has developed near the same level as the left, highlighting the pattern’s symmetry.

A decisive breakout above the neckline, situated between $174 and $176, particularly with strong volume support, could pave the way for a move toward the $185–$190 target range.

On the technical front, the $AAVE/$USDT chart reveals a well-defined Inverse Head and Shoulders pattern—a classic bullish formation that often signals a potential trend reversal following a downtrend. The left shoulder formed near $160, the head dipped to the $148–$150 zone, and the right shoulder is now taking shape around the same level as the left, underscoring the pattern’s symmetry.

Notably, the 50-day EMA (orange) is providing dynamic support around $165—a level from which AAVE recently bounced, aligning with the bottom of the right shoulder. Additionally, the 200-day EMA (red), currently near $152, served as critical support during the head formation, further reinforcing the developing bullish structure.

A confirmed breakout above the neckline at $174–$176, especially on strong volume, could open the door for a rally toward the $185–$190 target zone.

BNB Climbs on 13% Volume Spike – Will ETF Bid & Kyrgyz Deal Spark a Breakout?

Solana Headed for $900? Here’s the One Resistance Level That Could Stop It

XRP Price Forecast: Whale Movements Hint at Imminent Surge Toward $10 Mark

Bitcoin Price at $95,832: Are Bulls Back After Some Signs of Renewed Strength?

Leave a Reply