Bitcoin (BTC) traded near $104,450 during Wednesday’s European session, pulling back from recent highs as investors awaited the U.S. Federal Reserve’s policy announcement and monitored rising tensions between Israel and Iran.

Despite short-term selling pressure, optimism returned following the U.S. Senate’s approval of the GENIUS Act—a landmark development for stablecoin regulation in the United States.

The GENIUS (Guiding and Establishing National Innovation for U.S. Stablecoins) Act passed with a 68-30 vote, marking the first federal legislation to regulate fiat-backed stablecoins. The law mandates 1:1 reserve backing, regular audits, and licensing for issuers.

Importantly, compliant stablecoins will be exempt from SEC oversight, a significant win for fostering crypto innovation.

This newfound legal clarity is expected to boost institutional adoption and foster a more trustworthy environment for broader crypto engagement. Senator Bill Hagerty hailed the bill as a crucial step toward establishing the U.S. as the “crypto capital of the world.”

Geopolitical Tensions Add Downside Risk

Meanwhile, rising tensions in the Middle East have kept traders cautious. The conflict between Iran and Israel escalated after former President Trump called for Iran’s “unconditional surrender” in a social media post. Speculation about potential U.S. involvement continues to fuel market uncertainty.

BTC sentiment has weakened amid concerns over a possible wider regional escalation. The market remains highly sensitive to any new developments in the conflict, fostering a risk-off environment that has temporarily limited gains in digital assets. Nevertheless, investors view the GENIUS Act as a strong long-term bullish catalyst that could help counterbalance some of the geopolitical headwinds.

Fed Decision Looms, Triangle Pattern Forms for Bitcoin

Later today, the Federal Reserve is expected to keep rates steady at 4.25% to 4.50%, but markets will closely watch for dovish signals in the accompanying forecast. Indications of potential rate cuts later in 2025 could weaken the dollar and provide support for Bitcoin.

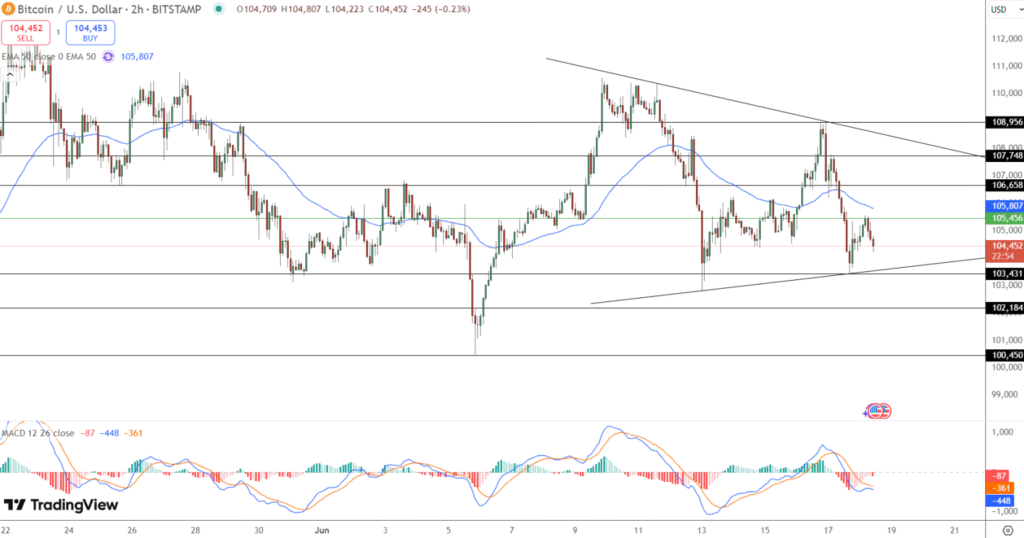

From a technical standpoint, Bitcoin’s price outlook remains bearish as BTC/USD consolidates within a symmetrical triangle on the 2-hour chart. Key resistance stands at 106,658, while support holds at 103,431. The 50-EMA has flattened around 105,807, underscoring the current indecision.

Additionally, the MACD momentum has turned negative, pointing to bearish pressure until a clear breakout defines the next direction.

Trade Setup

- Sell Entry: Below 103,430

- Target 1: 102,180

- Target 2: 100,450

- Stop-Loss: Above 105,800

This setup favors a short-term bearish position unless Bitcoin decisively breaks above the upper trendline. Wait for a confirmed candle close outside the triangle accompanied by strong volume before entering.

With macro headlines and regulatory changes converging, Bitcoin traders should stay alert and ready for increased volatility.

Bitcoin Price Prediction

Dogecoin Price Prediction: DOGE Nears Make-or-Break Level – Breakdown Could Get Ugly

XRP Price Prediction: Canada Approves First Spot XRP ETF – $1,000 XRP Coming?

ChatGPT’s o3 Pro Reveals Shocking DOGECOIN Price Prediction as It Tests Key $0.175 Support

Ethereum Whales Snap Up 871K ETH; BlackRock and Fidelity Bets Indicate Imminent $3K Breakout

Bitcoin Price Prediction: BTC Hits Wall at $109K as ETF, El Salvador, and Miners Boost Bull Case

Solana Price Prediction: As Wall Street Rotates Into Alts, SOL Could Lead the Next Mega Rally

Cardano Price Prediction: Explosive Ecosystem Growth Fuels Bullish ADA Outlook

Leave a Reply