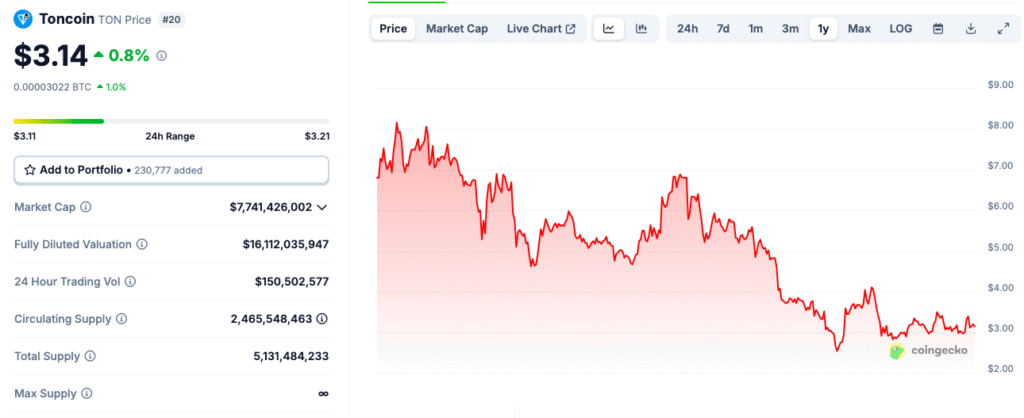

Toncoin ($TON) plummeted 67% over three months, dropping from $7.20 to $2.34, making it one of the worst-performing crypto tokens in Q1.

A weak 4.86% recovery last week did little to offset its staggering 52% loss over the past year, leaving traders cautious about the possibility of further declines.

The sharp drop, driven by fading confidence and volatile fluctuations, prompts a tough question: Is this a genuine buying opportunity or just a dead cat bounce?

$300M Deal or Deception? Elon Musk’s Denial Sends $TON Tumbling

A key catalyst was the arrest of Telegram CEO Pavel Durov in August, which unsettled investors in The Open Network ($TON) and raised concerns about the platform’s future.

Uncertainty remains over how much direct control Durov has over the blockchain, fueling doubts about the project’s ability to sustain its growth. Following this event, $TON’s price dropped by more than 25%.

More recently, on May 29, Toncoin plunged 7% after Elon Musk denied reports of a $300 million partnership between Telegram and his AI company, xAI.

Durov had previously claimed that Telegram would receive $300 million in cash and equity from xAI and keep 50% of the revenue from xAI subscriptions sold via Telegram.

However, Musk quickly refuted these claims, tweeting on X, “No deal has been signed,” casting uncertainty over the validity of the partnership.

Adding to these challenges, the TON blockchain faced a temporary outage on June 1, pausing block production for about 40 minutes.

The development team identified the problem at 12:51 UTC and quickly restored the network’s functionality.

Similar to other high-throughput chains like Solana and Sui, $TON seems vulnerable to short periods of downtime as validator operations grow more complex and network traffic increases.

Telegram Gifts Just Made NFTs Cool Again—Here’s How $TON Benefits

Despite these obstacles, $TON continues to draw interest from both institutional investors and retail enthusiasts.

Max Crown, co-founder of MoonPay and current CEO of the TON Foundation, has been actively promoting new initiatives aimed at reducing user friction and broadening crypto accessibility.

Telegram-based features like Telegram Gifts have helped boost NFT engagement.

A notable example is Plush Pepe, a Telegram-native NFT project that surged from $1,110 to around $8,500 (approximately $2,728) in less than two weeks.

Additionally, the TON ecosystem now supports Ethena’s stablecoins, $USDe and $tsUSDe, enabling Telegram users to earn up to 18% APY on their crypto dollars.

Blockchain intelligence company Arkham, which monitors over 2.1 billion labeled addresses, has also integrated TON-based mini-apps to expand its presence within the Telegram ecosystem.

Toncoin RSI Flashes Bullish Divergence—Is a $5.60 Rally Next?

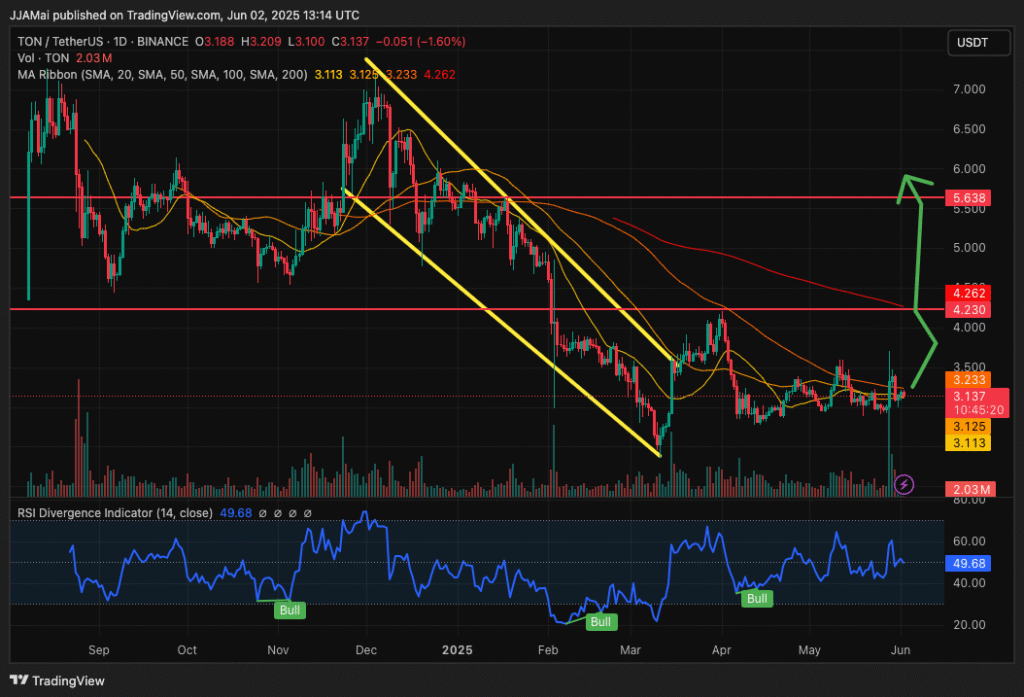

From a technical perspective, the $TON/$USDT daily chart shows a noticeable trend reversal.

$TON has broken above a descending channel (marked in yellow), signaling a possible end to its prolonged downtrend.

The token is currently trading around $3.13, just above a cluster of important short-term moving averages (20, 50, and 100 SMA) between $3.11 and $3.23, which is serving as near-term support.

The next significant resistance zone is between $4.23 and $4.26, coinciding with the 200-day Simple Moving Average (SMA). Breaking above this level could pave the way for a potential rally toward the $5.63 target.

On the other hand, if momentum falters, a pullback to the support area near $3.11 could occur.

Currently, the RSI stands at 49.68—neutral but leaning bullish—supported by several bullish divergence signals. A move above 50 would provide stronger confirmation of upward momentum.

Toncoin Price Prediction

Whale Signal or Exit? XRP Price Prediction After 44M Tokens Leave Exchange

$BNB Rockets 19% in May – Can SEC Win & ETF Hype Propel It to $2K?

Leave a Reply