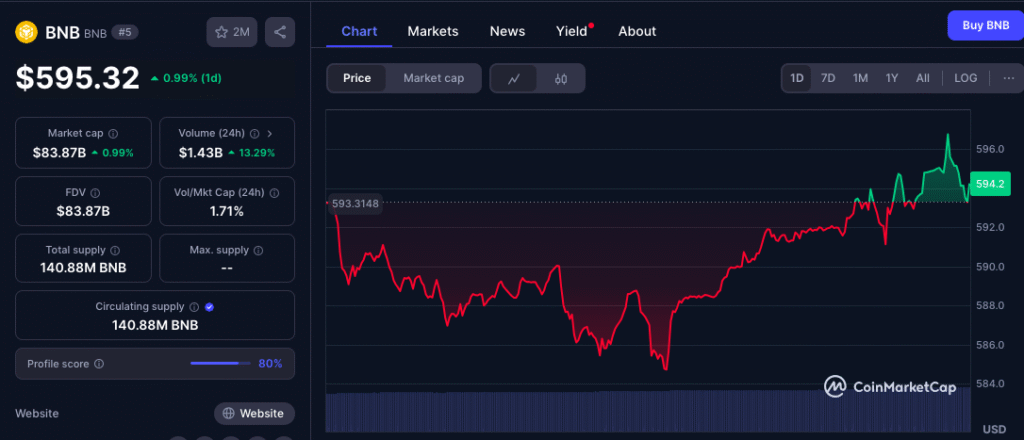

Binance Coin ($BNB) is currently trading at $595.32, reflecting a modest 1% gain after briefly dipping to an intraday low of $584.61.

The slight uptick follows an announcement by Binance founder Changpeng Zhao on May 4, revealing a strategic partnership with Kyrgyzstan. The collaboration aims to launch a nationwide crypto payments infrastructure, introduce blockchain education programs, and establish strategic reserves that will include $BNB and Bitcoin ($BTC).

$BNB Trading Volume Surges Following VanEck’s ETF Filing

As the native utility token of Binance Smart Chain (BSC), $BNB has experienced a 13% increase in trading volume over the past 24 hours, with more than $1.4 billion exchanged.

This surge in activity has allowed $BNB to maintain its position as the fifth-largest cryptocurrency by market capitalization, according to CoinMarketCap.

As a core component of the Binance ecosystem, $BNB powers transactions, smart contracts, and various decentralized applications on the BSC Chain.

Further boosting bullish sentiment, Binance founder Changpeng Zhao announced on May 5 via X (formerly Twitter) that asset management firm VanEck has officially filed for a spot BNB ETF.

Initially submitted under Form S-1 on May 2, the proposed VanEck BNB ETF would be the first U.S.-registered fund offering direct exposure to $BNB, pending regulatory approval.

Although the ETF’s ticker has not yet been disclosed, the preliminary filing suggests that staking could be incorporated, potentially enabling investors to earn additional $BNB rewards.

Binance Smart Chain Maintains Strong Fundamentals As Stablecoin Activity Booms, Generating Record On-Chain Fees

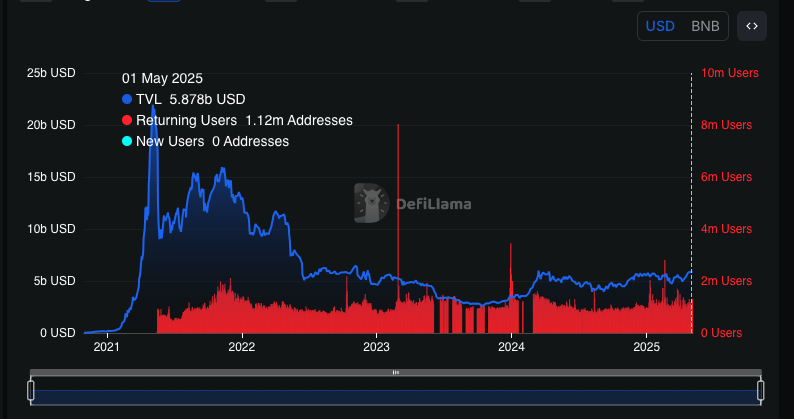

Even amid a quieter market, BNB Chain continues to showcase its resilience. With over $5 billion in total value locked and more than 1 million active addresses, it ranks just behind Bitcoin, Ethereum, and Solana in terms of network activity.

Technical Indicators: Quiet Accumulation Phase or Breakout Ahead for $BNB?

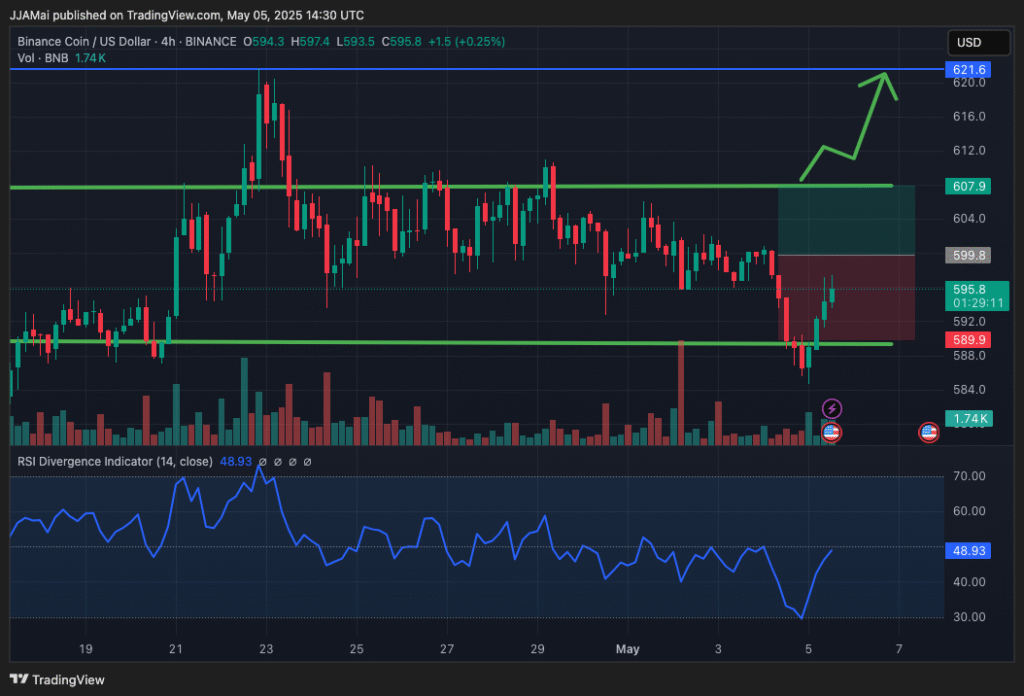

The 4-hour chart of $BNB/$USDT shows that after briefly dipping below the $592 support zone, $BNB quickly rebounded, suggesting the move may have been a bear trap.

Following this false breakdown, a bullish push ensued. The price is now trading around $595.8 and forming higher lows, signaling an early indication of strengthening buying pressure.

The $589.9 level is emerging as a strong support floor, while immediate resistance stands at $607.9.

If $BNB can decisively break through this horizontal resistance zone, the next logical upside target is around $621.6—aligned with previous highs and a potential breakout trajectory.

This bullish outlook is further supported by the Relative Strength Index (RSI), which has rebounded from near-oversold levels and currently sits at 48.93.

Overall, the short-term outlook for $BNB remains cautiously bullish. If the price holds above the $592 zone and breaks through the $607 resistance with conviction, a move toward $621 becomes a realistic target.

However, a close below $589 would invalidate this setup and shift the focus back toward bearish momentum.

Solana Headed for $900? Here’s the One Resistance Level That Could Stop It

XRP Price Forecast: Whale Movements Hint at Imminent Surge Toward $10 Mark

Bitcoin Price at $95,832: Are Bulls Back After Some Signs of Renewed Strength?

Solana’s Booming Price Path From $147.91 to $200: Key Resistance Levels and Timeframes to Watch

Leave a Reply