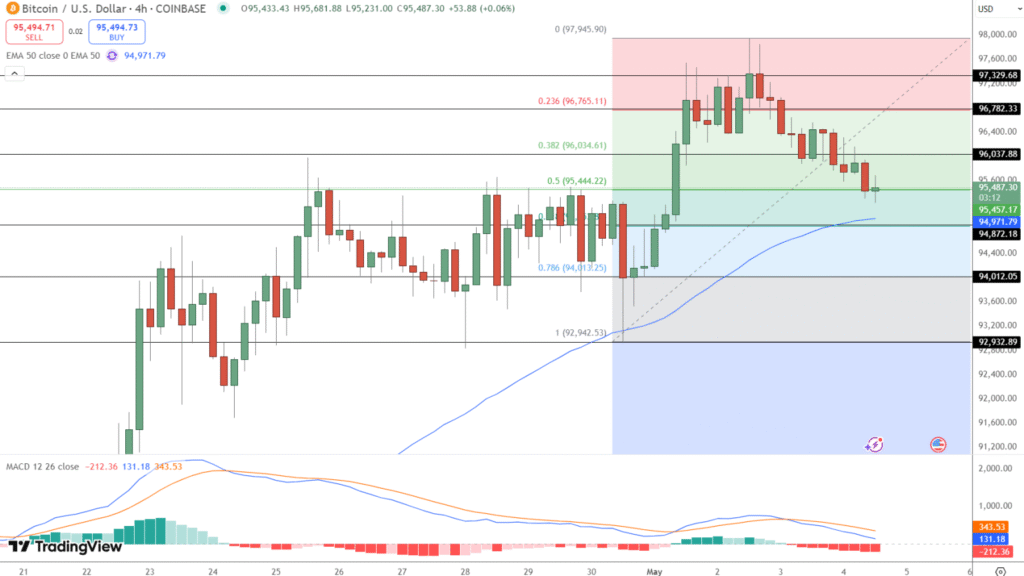

Bitcoin is hovering around $95,832, showing resilience after a brief dip to the 0.5 Fibonacci retracement level at $95,444.

The world’s largest cryptocurrency dropped 0.52% in the past 24 hours but has gained 1.71% over the past week. A recent high of $97,754 confirms that bullish momentum is still intact.

Technical indicators suggest that Bitcoin is holding steady above the 50-period EMA ($94,971) and the $94,872 support zone.

This confluence of key levels creates a solid foundation, and any bounce from this region could propel BTC toward $96,782 and $97,329.

The MACD remains in bearish territory, but low trading volumes indicate that the recent move lacks conviction, signaling potential for a rebound once buyers re-enter.

Trade Setup:

- Entry: Wait for a confirmed bounce above $95,444

- Targets: $96,782 → $97,329

- Stop Loss: Below $94,870

Institutional Ownership Hits 9%, Supporting Bitcoin Price

What’s keeping Bitcoin afloat amid ongoing volatility? Institutional demand.

On-chain data reveals that institutional entities now hold approximately 9% of Bitcoin’s total supply. This includes heavyweights like BlackRock and Fidelity, whose consistent inflows into spot Bitcoin ETFs are helping to establish a new kind of price floor.

These ETFs offer easier access to BTC, especially for traditional finance players, and help reduce market volatility. Unlike short-term traders, institutions tend to hold long-term—tightening circulating supply and applying upward pressure over time.

Institutional Impact at a Glance:

- BlackRock and Fidelity lead growing ETF inflows

- ETF accessibility reduces sell-side pressure

- Long-term holdings tighten supply, stabilizing prices

This shift mirrors historical patterns in traditional markets, where regulated instruments open the door for large-scale, steady capital inflows.

Global Crypto Expansion Adds Long-Term Support; Bitcoin Up?

Binance, the world’s largest crypto exchange, is accelerating Bitcoin adoption through strategic global partnerships.

Its latest collaboration with Kyrgyzstan’s investment agency brings Binance Pay and blockchain education to the country—an initiative supported by President Sadyr Japarov. The broader goal: to establish a nationwide crypto infrastructure and lay the groundwork for digital financial inclusion.

At the same time, Binance is advising countries like Pakistan on crypto regulation, reinforcing digital asset legitimacy across emerging markets.

These developments significantly expand Bitcoin’s reach and utility—particularly in regions with underdeveloped banking infrastructure, where crypto can offer more accessible financial solutions.

Adoption Highlights:

- Kyrgyzstan to implement Binance Pay and launch nationwide blockchain education

- Pakistan exploring crypto regulation with Binance’s strategic input

- Enhances Bitcoin’s real-world relevance and supports growing transaction volumes

BTC Bull Token Crosses $5.28M as Flexible 78% Staking Yield Draws Investors

BTC Bull Token ($BTCBULL) is gaining momentum, surpassing $5.28 million in funds raised as it approaches its $5.96 million presale cap.

Priced at $0.00249, BTCBULL sets itself apart from typical meme coins by offering real-world utility through flexible, high-yield staking.

Utility-Driven Demand Fuels Growth

Blending crypto culture with tangible rewards, BTCBULL offers investors an estimated 78% APY—while maintaining full liquidity and no lockup period. This user-friendly model has struck a chord with yield-seeking investors navigating an uncertain crypto landscape.

Current Presale Stats:

- USDT Raised: $5,320,201.23 of $6,070,369

- Token Price: $0.002495 per BTCBULL

- Staking Pool Total: 1,342,549,903 BTCBULL

- Estimated Yield: 78% APY

With less than $750K remaining before the next funding milestone, the BTCBULL presale window is closing quickly. For investors seeking high-yield opportunities with instant liquidity and no lockups, BTCBULL is emerging as a standout contender in the 2025 crypto cycle.

Solana’s Booming Price Path From $147.91 to $200: Key Resistance Levels and Timeframes to Watch

Bitcoin Price Steadies at $96,362 as Market Sentiment Shifts to Greed: What’s Next?

New Litecoin Price Prediction Targets $100 and Beyond – Where Is LTC Headed Next?

Dogecoin Price Coiling for a Monster Move – Are Whales Betting on $5 DOGE?

Leave a Reply