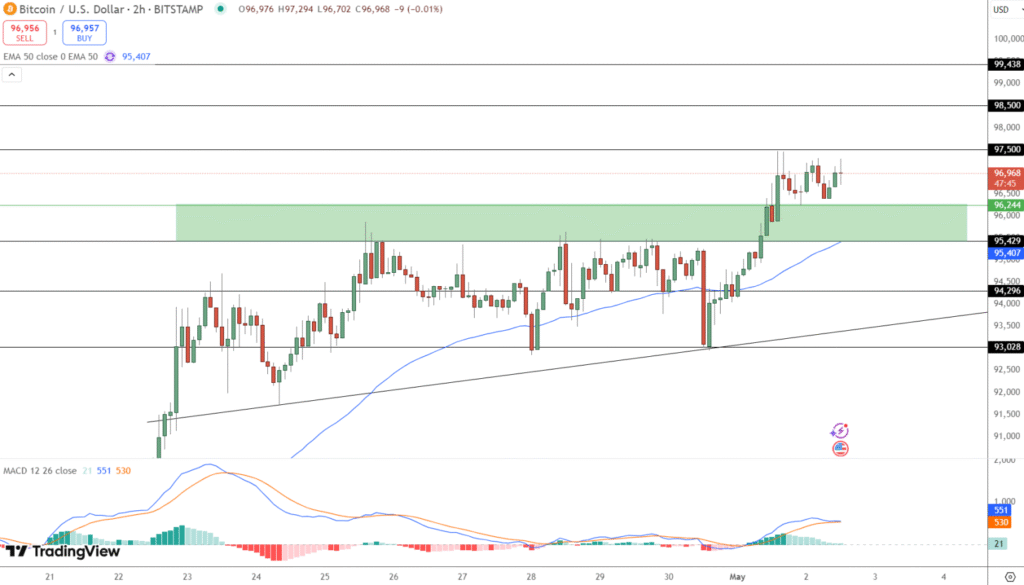

Bitcoin (BTC) is currently trading just below $97,000, with traditional markets potentially signaling further upside. After bouncing off the $96,244 support level, BTC has remained stable, despite ongoing macro volatility. The S&P 500’s recovery from its April lows is now being seen as a broader signal of confidence for risk assets, including cryptocurrencies.

Since March, the total crypto market cap has risen by 29%, while the S&P 500 has declined by 2%. Bitcoin is consolidating just under the $97,500 resistance level, and a breakout above this could pave the way for potential moves toward $98,500 and $99,438.

Key levels to watch:

- Immediate support: $96,244

- Key resistance: $97,500 → $98,500 → $99,438

- 50 EMA (2H): $95,407

- MACD: Bullish but moderating

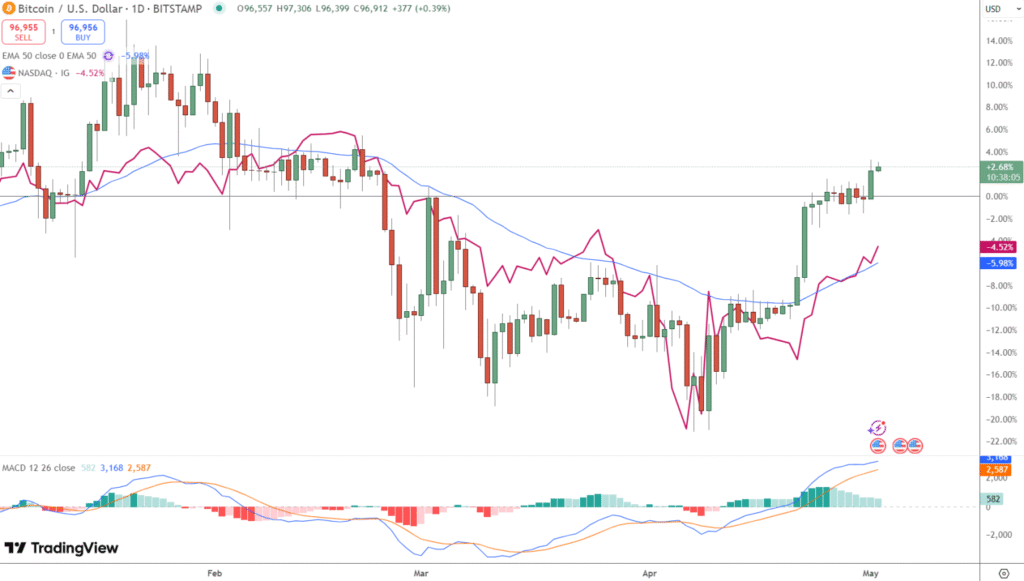

Nasdaq Lags, Bitcoin Leads

The divergence between Bitcoin and the Nasdaq is garnering attention. As of early May, BTC has gained 2.7%, while the Nasdaq remains down 4.5%.

The Nasdaq continues to struggle under pressure from interest rate uncertainty and weakening tech momentum. In contrast, Bitcoin has been supported by ETF-driven inflows and the potential for more accommodative monetary conditions.

Bitcoin has reclaimed its 50-day EMA, while the Nasdaq remains below it, which could signal a shift in market leadership. This divergence is sparking renewed discussions about the long-anticipated decoupling of Bitcoin from traditional markets.

Liquidity Shift May Keep Crypto in Play

Wall Street earnings have surpassed expectations, with Microsoft reporting a 13.2% year-over-year revenue increase and Meta delivering a strong earnings beat. The S&P 500 has risen from 4,835 to 5,635 in under a month. Meanwhile, the Federal Reserve is contemplating resuming asset purchases, a move that typically boosts liquidity-sensitive assets like Bitcoin.

Trade tensions between the U.S. and China have eased somewhat, with new waivers and tariff adjustments indicating that both sides are backing away from further escalation.

What’s driving the bullish outlook:

- Increased ETF demand and improving liquidity conditions

- Strong earnings from Microsoft and Meta

- The Fed signaling a more dovish approach with potential policy tools

- Bitcoin outperforming tech stocks

Conclusion: A Decoupling in Progress?

Bitcoin hasn’t fully decoupled from equities, but it is leading the way. Over the past six months, crypto has gained 29%, while the S&P 500 has seen a decline.

With Bitcoin holding above key technical levels and macro conditions improving, the risk-reward outlook seems to favor the bulls—at least for now.

BTC Bull Token Crosses $5.22M as Flexible 78% Staking Yield Draws Investors

BTC Bull Token ($BTCBULL) continues to gain momentum, surpassing $5.22 million in funds raised as it nears its $5.96 million presale cap. Priced at $0.00249, the token is positioning itself as more than just a meme coin by offering real utility through flexible, high-yield staking.

Utility-Driven Tokenomics Fuel Demand

Unlike typical meme tokens, BTCBULL combines crypto culture appeal with tangible staking rewards. Investors can currently earn an estimated 78% APY while maintaining full liquidity, as unstaking is allowed at any time without penalties or lockup periods.

This model has resonated with investors seeking yield without compromising access, especially in the volatile crypto environment.

Current Presale Stats:

- USDT Raised: $5,226,067.3 of $5,963,550

- Current Price: $0.00249 per BTCBULL

- Staking Pool Total: 1,342,549,903 BTCBULL

- Estimated Yield: 78% annually

With less than $750K remaining before hitting the next milestone, the presale window is closing quickly. For investors seeking high yields with exit flexibility, BTCBULL is becoming an increasingly attractive option in the 2025 crypto cycle.

XRP Future Price Prediction: ETF Rumors Reignite 10x Bull Case – Here’s What Traders Expect

World Chain Taps Circle USDC for 25M Users – Is $2 Trillion Stablecoin Boom Next?

Cardano Price Prediction: 1 Billion ADA Traded in 24 Hours – Is $100 ADA Closer Than You Think?

GENIUS Act Revival Triggers Senate Showdown Over $2B Trump Stablecoin Deal

Leave a Reply